ICYMI: Jervois Global taken private in rescue deal

News Analysis

9

Jan

2025

ICYMI: Jervois Global taken private in rescue deal

Jervois Global Limited (Jervois) reached an agreement with Millstreet Capital Management LLC (Millstreet) on a proposed recapitalisation.

US investment firm and Jervois lender Millstreet will take control of Jervois as part of a pre-packaged US Chapter 11 filing, injecting US$145M into the company and converting more than US$100M of loans into equity.

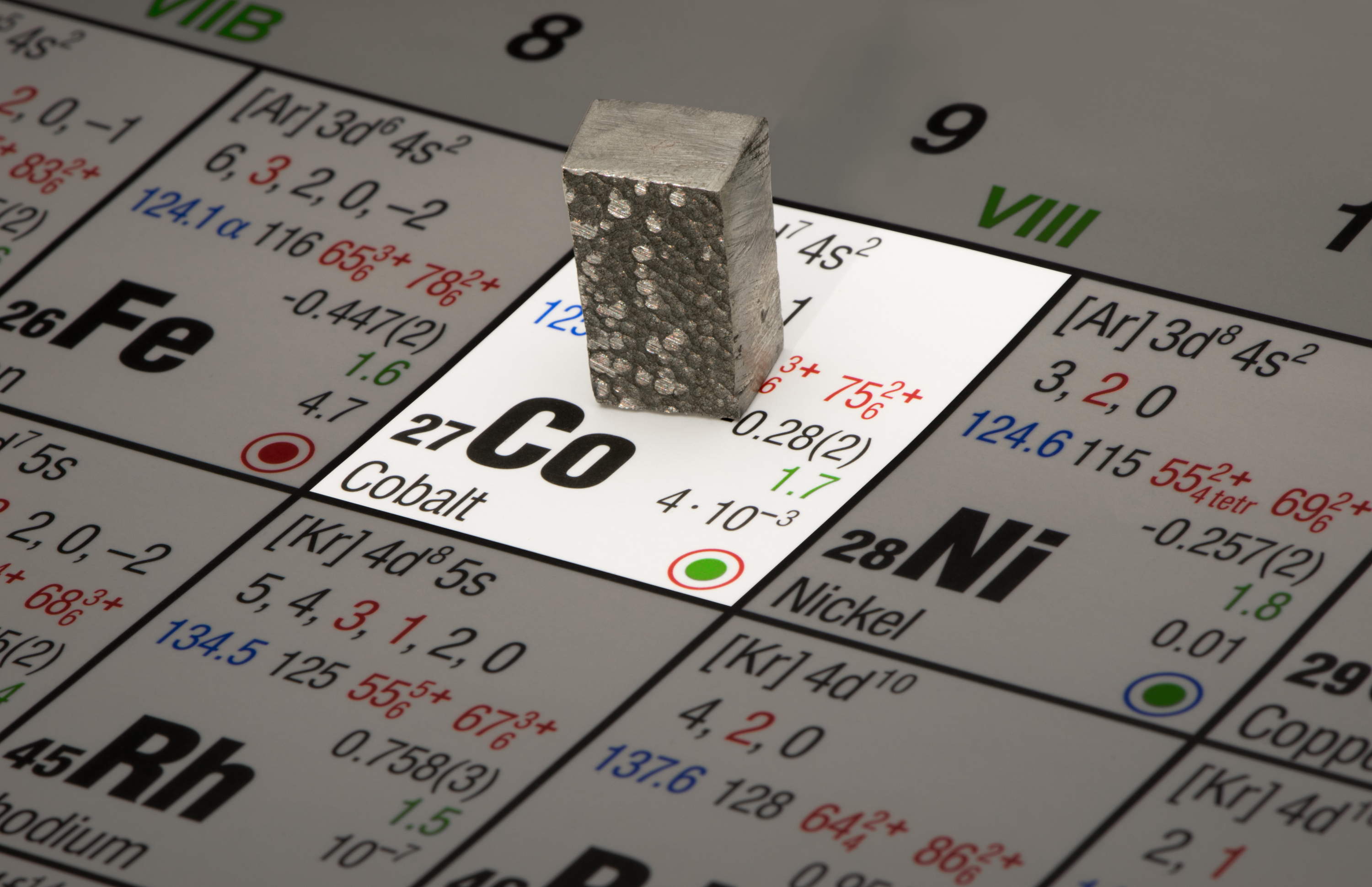

Jervois was positioned to be a vertically integrated cobalt producer with a mining operation in the USA, a cathode refinery in Brazil, and a cobalt powder and chemical production facility in Finland.

However, the company has been struggling owing to low cobalt prices, which fell by 50% between 2022 and 2023 and a further 20% in 2024. These price levels, combined with low production volumes of a non-standard concentrate product, contributed to the idling of its ICO cobalt mine, the only cobalt mine in the USA, in 2023.

Low cobalt (and nickel) prices, as well as insufficient feedstock, have also hindered the restart of its São Miguel Paulista (SMP) nickel and cobalt refinery in Brazil, which it acquired from Companhia Brasileira de Alumínio in 2020 and for which it completed a BFS for a Stage 1 restart in 2022.

Thus far, the production of cobalt powders and salts at the Kokkola Refinery in Finland (production lines acquired from Freeport Cobalt in 2021) has continued despite the challenging market conditions.

The US$145M of new pre- and post-recapitalisation equity capital will be used to fund the business and certain growth initiatives, including the restart of SMP in Brazil. Importantly, it may create a lifeline for a cobalt business that has the potential to be a vertically integrated alternative in a Chinese-dominated market, should prices recover.