China - Expanding embargoes and what could be next?

News Analysis

4

Feb

2025

China - Expanding embargoes and what could be next?

Project Blue comments on China’s export ban announcement from this morning.

China’s Ministry of Commerce (MOFCOM) announced further dual-use export embargoes on five critical materials this morning, an unusual move during China’s week-long New Year holiday.

The list of materials under export control now include Tungsten, Tellurium, Bismuth, Molybdenum, and Indium.

The dual-use justification for the export controls cites national security as the basis for the decision, an increasingly common expression used by global leaders intending to protect domestic industries and supply chains.

We make two observations on this most recent announcement.

First, the materials included are used in a wider range of industries, adding consumer goods and the energy sector to the list of critical industries previously impacted. The materials restricted to date (gallium, germanium, antimony) were focused on semiconductors and defense applications. Graphite export restrictions were introduced earlier in December 2023, affecting the battery supply chain.

Indium is used in electronics, particularly flatscreen and touchscreen displays. Tungsten is used in tools and wear materials for the automotive industry, as well as defense, aerospace and semiconductor manufacturing. Molybdenum is largely used as a steel alloy in applications requiring high strength and heat resistance, such as pipelines, engines and high-speed tools.

If the export restrictions hold, the potential market squeeze could push prices higher, particularly ex-China. We would note that antimony was already facing partial restrictions in mid-2024, and over the last five months has continued to bifurcate from EXW China prices.

The move to impose export restrictions on raw and processed materials is aligned with China’s “Made in 2025” (MIC2025) strategy, which for the last ten years has been targeting the upgrading of China’s manufacturing sector, i.e., to capture more of the downstream and value-add supply chain, and reducing reliance on foreign technology.

Second, the announcement this morning now includes restrictions on technology transfer for these materials as well. From the announcement translated to English: “Technology and information for the production of item [x] (including process specifications, process parameters, processing procedures, etc.)”.

It is no longer a simple ban on the movement of goods, it is also the technology to process and refine these materials for their critical applications that China is embargoing.

This follows on technology transfer restrictions in the lithium-ion battery sector, and will likely form a part of any ‘trade’ restrictions going forward. However, just as DeepSeek surprised markets last week with its capabilities despite restrictions on AI technology to China, perhaps China’s export embargoes could set in motion innovative solutions for critical industries in the rest of the world.

Which markets could be next?

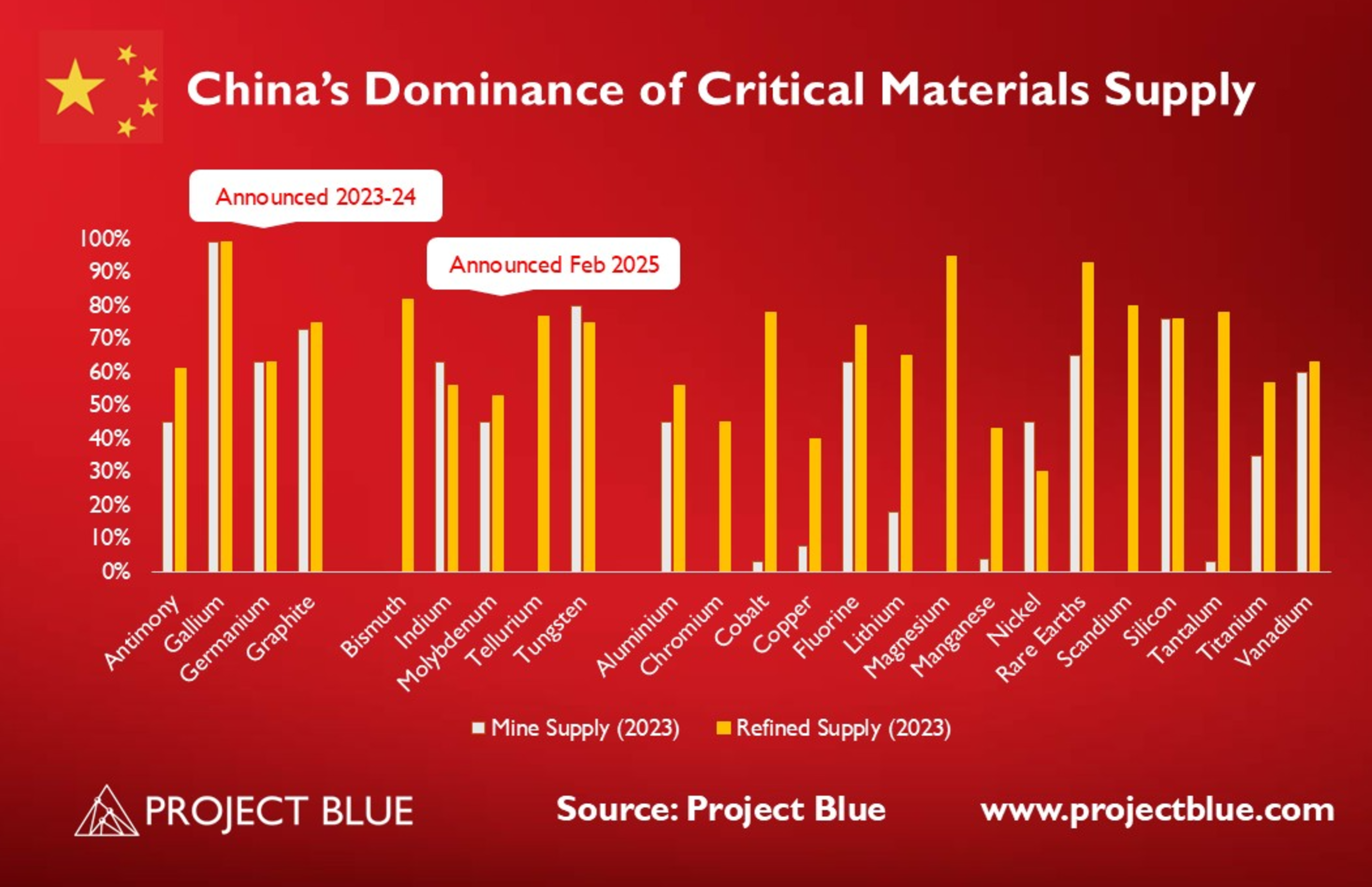

We note that the critical material markets announced to date are areas where China, as a single country, is dominant in both the mining and refining of the materials. Increasing the competitiveness of downstream production is far simpler when most of the supply chain is available and the technology is established or, at least, accessible.

While it is difficult to speculate on which markets could be next – given most of the critical materials covered by Project Blue below are used in various critical industries around the world – those where China has upstream and midstream expertise may have a higher probability of being embargoed (including technology transfer) in the next round, if there is one.