Trump’s tariffs – Potential impact on North America's copper market

News Analysis

6

Feb

2025

Trump’s tariffs – Potential impact on North America's copper market

President Trump’s announcement of the imposition of 25% tariffs on neighbouring Canada and Mexico (since deferred by one month) and 10% on China, would disrupt the North American copper market.

The economies of the United States, Mexico and Canada are deeply integrated. The signing of the United States-Mexico-Canada Agreement (USMCA) in 2020, as the successor to the North America Free Trade Area (NAFTA), emphasised balanced reciprocal trade to grow the North American economy. Nowhere is this integration more apparent than in the copper industry.

Copper’s trade flows in concentrates, cathode and scrap are truly global, although they are also comprised of powerful established regional dynamics. However, the markets for copper semi-manufactures and wire and cable are regional. If tariffs of 25% are enacted on Canada and Mexico in March, and they stay in force for any length of time, then the impact on certain links in the copper supply chain could be severe and damaging. Plants could close, many jobs will be lost permanently, trade flows will have to adjust rapidly, and some regional supply chains may be transformed into global ones with all the compliance costs and risks that this would entail. In time, Project Blue believes that trade flows in concentrates, cathode and even scrap could eventually adjust, albeit with cargoes being re-routed to new national markets and at different margins. However, this would not be possible for semi-manufactures, whose weight and low added value preclude inter-regional trade. Canada stands to be most severely impacted.

This is best illustrated with the example of Canada. 99% of the country’s exports of wire rod and drawn wire go to the USA, (205kt in 2024). This represents over 80% of the output of Canada’s sole wire rod mill operated by Nexans in Montreal. The loss of the US export market would mean it was no longer viable. This wire rod mill is fed by cathode from the neighbouring Cox Creek Refinery (CCR) operated by Glencore. CCR would have to find new markets for its cathode in Europe or China. As it stands, 99% of CCR’s cathode exports already go to the USA, (140kt last year). The other main part of the supply chain that would be affected is copper scrap. In 2024, 48% of Canadian scrap exports were destined for the USA. Tariffs of 25% would end this trade, forcing mills to send these volumes to China or Europe if this were economic.

In the case of Mexico, 33% of its copper scrap exports went to the USA last year, a significant contribution to America’s ability to decarbonise and save energy by utilising secondary raw materials instead of primary sources. This scrap could be sent to China but consider the carbon footprint of shipping it across the Pacific Ocean? Mexico’s key role as a supplier of copper to the USA is in the form of auto parts, particularly wiring harnesses, and electric motors. 99% of its auto wiring harness exports are to the USA, (220kt copper content last year). Wiring harness assembly is labour intensive, and this supports tens of thousands of jobs, mainly for women, in Mexico. The president of Sumitomo Electric Industries (SEI), Mr Osamu Inoue, said that the USA would be ‘strangling itself’ if it applied 25% tariffs to harnesses assembled in Mexico. SEI would then relocate all its output to Central America, the Philippines and Vietnam, where labour costs are far lower, and where it would only pay a 5% tariff to export to the USA. However, lengthy trans-pacific supply chains are vulnerable to disruption and delays. Much of the copper wire and connectors used in these harnesses are exported from the USA to Mexico, so this tonnage would be lost to Asian consumers, the reverse of the stated objective.

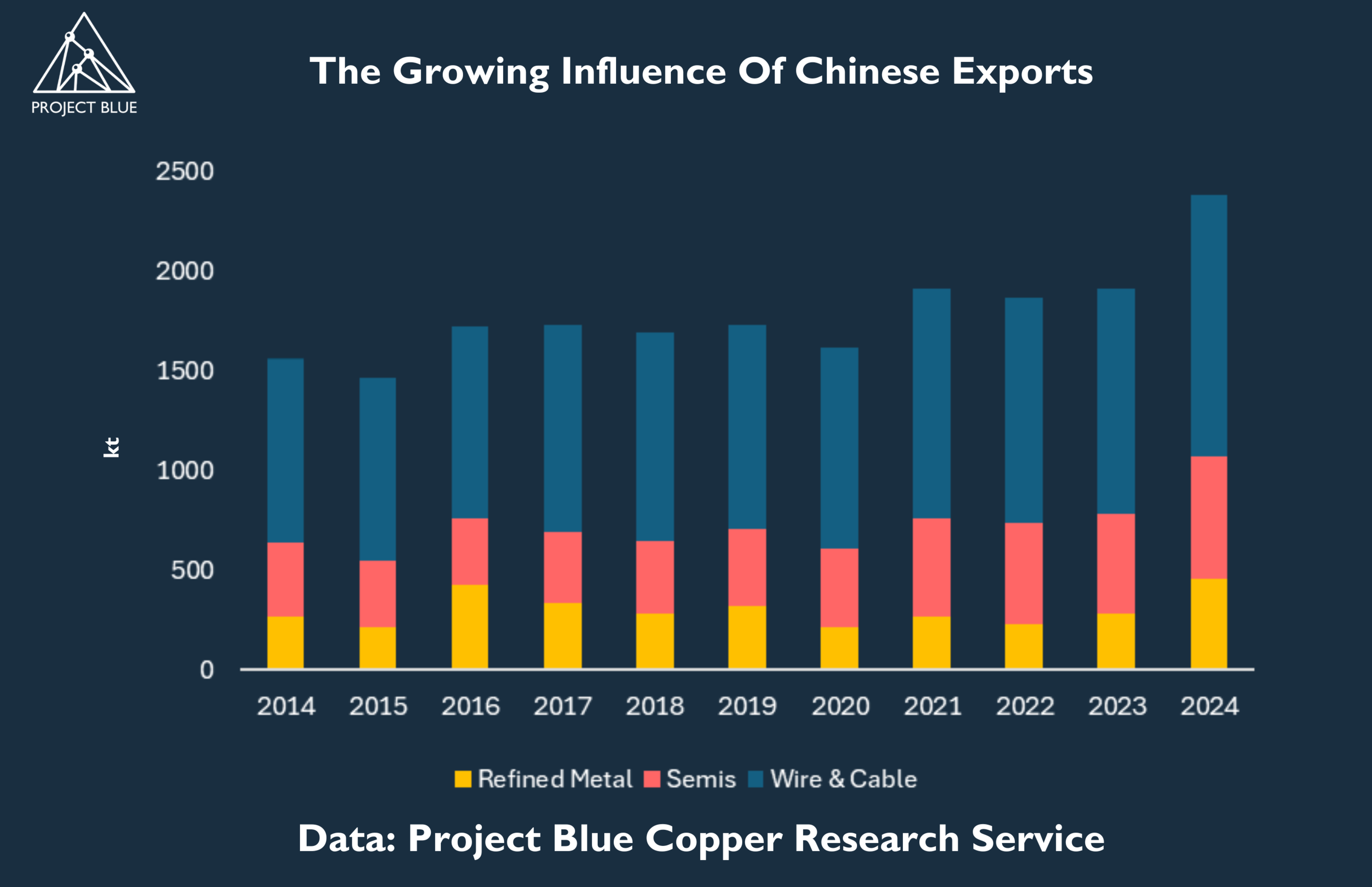

China’s main exports to the USA are in the form of insulated wire and cable, electric motors, brass parts, and home appliances, such as air conditioners, fridges, and freezers. In aggregate this amounts to a considerable volume of contained copper. A 10% tariff may not be sufficient to deter such trade, or if does, China will redirect these products to other markets in the Americas, Europe, and Asia, at little cost to itself. In the short term, this could further dampen Chinese copper consumption prospects.

The introduction of the proposed tariffs on Canada, Mexico and China would no doubt be net positive for US copper consumption prospects, primarily in the wire rod business. However, this would not be so positive because of the potential loss of auto wire exports to Mexico. There is some surplus wire rod capacity in the USA, and 270ktpy of new capacity is being commissioned at IMC, a subsidiary of the Ames Copper group, in Shelby, NC. This would theoretically be capable of replacing all the imports from Canada. But Trump has also clouded the outlook for potential new copper demand growth in the USA in EVs and offshore wind, so the eventual gains may not be as large as what was previously envisioned.

The rules of the game may change once again once the USA finally recognises copper as a “critical material” as advocated by the US CDA. After that, America may impose export restrictions of its own on the red metal, potentially on scrap, in the same way as China has restricted exports of rare earths and strategic metals. ReMA (formerly ISRI) has countered, continuing to advocate for free trade and no restrictions on exports of recycled materials, that safeguard thousands of blue-collar jobs in the recycling industry. Retaliatory tariffs by China, Mexico and Canada would cause harm to other sectors of the American economy and set the World on a protectionist path that will diminish free trade and economic growth.

The author, Jonathan Barnes, Principal Analyst, Copper Demand, Project Blue, will be presenting at this year’s American Copper Council Spring Convention in Nashville, TN, 23-25 April.