South Africa’s ferrochrome industry: facing structural decline or adaptation?

News Analysis

20

Mar

2025

South Africa’s ferrochrome industry: facing structural decline or adaptation?

The South African ferrochrome industry is under increasing strain as production costs rise and market conditions remain weak.

Merafe Resources, one of the country’s key producers, recently announced a review of its operations, stating that up to eight of its 12 operational furnaces might be suspended by May 2025 if no economically viable alternative is found which may see the company pivot to mainly selling chrome concentrate.Merafe emphasised that, without effective interventions, ferrochrome production could experience a substantial reduction. This review follows ongoing economic difficulties within the global ferrochrome market and continued capacity growth in China. Despite record imports of South African ferrochrome in 2023 and 2024, China’s growing output has kept the domestic market oversupplied, keeping prices at their lowest levels, last seen during the pandemic. Along with many South African PGM producers, the elevated chrome ore prices have significantly reduced the impact of increasing input costs and changing market landscapes.

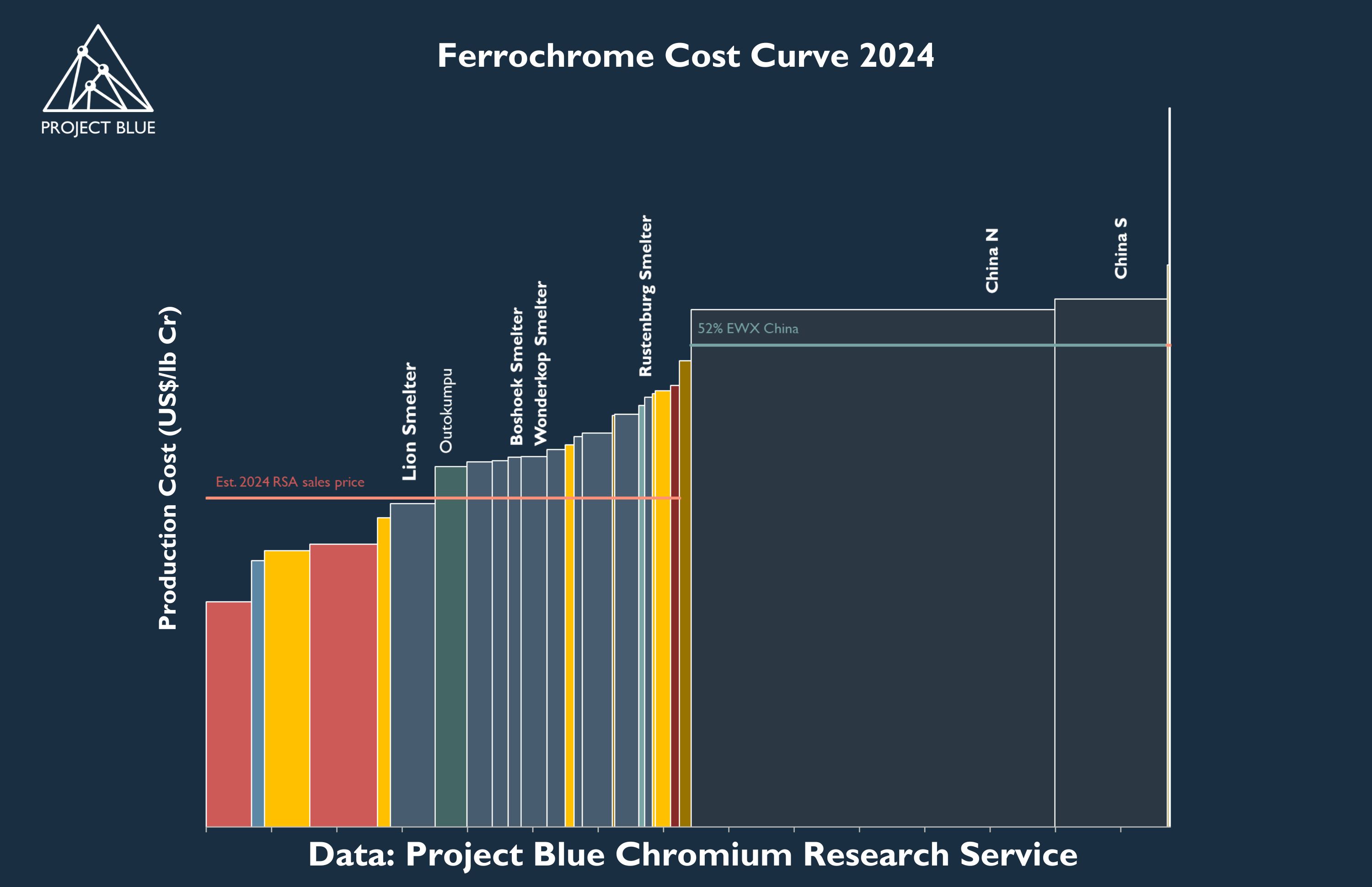

The rising ferrochrome production in China is import-reliant, as the country has negligible domestic ores. Demand for chrome ore has ramped up, and despite record imports in 2024, China has not been able to build a healthy port stockpile as ferrochrome production reached record highs, creating an oversupply in the domestic market. China also relies on ferrochrome imports to meet demand, especially as seasonal energy price fluctuations affect output volumes and contribute to variable input costs. A decline in South African ferrochrome would necessitate ongoing production at Chinese smelters, requiring further ramp-ups to replace shortfalls that imported ferrochrome has historically alleviated. However, increasing energy costs have continued to move Chinese producers to the right of the cost curve, which may impact future production volumes.

Electricity costs: the main constraint

Electricity remains the largest single cost in ferrochrome production, and rising power prices are placing smelters under severe financial pressure. Smelting ferrochrome requires around 4MWh of electricity per tonne of metal produced. Since 2005, South Africa’s electricity tariffs have increased by 947%, with another 12.7% increase scheduled for April 2025. These costs have made production increasingly unprofitable, particularly for high-cost smelters like Rustenburg.

High energy costs have prompted many producers to reduce ferrochrome production and increase ore exports, which has seen South Africa move from being the largest global ferrochrome supplier to the largest supplier of chromium ores. Ferrochrome prices are now at their weakest levels since the pandemic, making it difficult for South African producers to operate profitably. With weak prices and high costs, furnace closures are becoming more likely, which could fundamentally change the country’s role in the global market.

South Africa’s National Energy Regulator (NERSA) reviews and approves tariff increases proposed by Eskom, and has allowed negotiated pricing arrangements (NPA) for energy-intensive industries, including ferrochrome smelting. NERSA's current approach to calculating NPAs continues to consider only baseload requirements, excluding self-generation and renewable energy sources. Glencore-Merafe currently holds NPAs for 800MVA capacity for all its smelters, with the Rustenburg smelter receiving its own NPA for 225MVA, which has been under hot care & maintenance (C&M) since September 2024. To continue qualifying for NPA rates, Glencore-Merafe must maintain ferrochrome production levels at or above the stipulated minimum requirements of 80GWh consumption or 70% load factors.

The Rustenburg smelter is the highest-cost smelter in the Glencore suit, and with the very low pricing environment for South African ferrochrome around US$70-85/lb Cr, Project Blue estimates that Rustenburg losses amount to twice that of the Boshoek and Wonderkop smelters. The possible closure of these operational furnaces could result in a drop of up to 1.4Mt of South African charge chrome, 46% lower than 2024 output. While more than 50% of South Africa’s charge chrome exports go to China, other major stainless steel-producing regions, including the EU, USA, Japan, and South Korea, also depend on this supply. With furnace closures limiting availability, these markets will need to adjust sourcing strategies, potentially increasing reliance on alternative suppliers. In Europe, companies like Vargön Alloys in Sweden, traditionally focused on high-carbon ferrochrome, have considered shifting to charge chrome production to meet regional demand, which could help alleviate supply pressures within the European market.

The energy crisis is not just a financial problem but a structural one. South Africa has already lost its position as a leading ferrochrome producer to Chinese producers. With further smelters being placed under C&M, producers are instead turning to raw ore exports. This shift reduces value addition within the country, leading to lower tax revenues and job losses while weakening South Africa’s role in the ferrochrome supply chain.

A shift toward chrome ore exports amid infrastructure challenges

The potential reduction in ferrochrome production in South Africa is expected to release an additional 3.2Mtpy of chrome ore which will be sold to the international ferrochrome market. This could add over 12% to South Africa’s export volumes y-o-y. South Africa is responsible for more than 80% of global chrome ore supply, with China’s imports from South Africa reaching a record high in 2024.

Logistical challenges between mines and the export market are a significant bottleneck for South African chrome producers, as the state-owned rail and ports company, Transnet, has faced ongoing financial, structural, and theft difficulties. The increasing demand for chrome ore and high-carbon ferrochrome has resulted in a growing volume of material being transported by truck. Additionally, the limited operational capacity at South African ports has forced producers to route their ore through Komatipoort to the Port of Maputo. By 2023, Maputo port handled more than 50% of South African chrome exports and is poised to capture an even larger market share, based on year-to-date exports through the Komatipoort border. While this has helped move material, it has also created new risks, as seen in late 2024, when post-election unrest in Mozambique temporarily closed the Lebombo border. The Port of Maputo’s dry bulk terminal, which has handled over 50% of Southern Africa’s chrome ore exports since 2023, still managed to achieve a 14% y-o-y growth for the 2024 financial year. Despite the disruptions, high volumes at the port shielded the port against the impact of the post-election protests.

Adapting to a changing market

The struggles of South Africa’s ferrochrome sector coincide with a period of restructuring in the global stainless steel industry, driven largely by the need to reduce carbon emissions. Stainless steel manufacturers worldwide are responding by shifting towards renewable energy and low-carbon production methods. European producers, for example, have been investing in electric arc furnaces with renewable electricity, increasing scrap usage, and sourcing ferroalloys from low-carbon suppliers. Outokumpu in Finland, a major stainless producer, operates its ferrochrome smelter using mainly nuclear and hydropower, achieving a ferrochrome carbon footprint 67% lower than the industry norm. The majority of South Africa's baseload energy comes from coal-powered stations. This reliance on coal puts the country's ferrochrome industry at a disadvantage, especially in a market that increasingly prioritizes low carbon emissions. Additionally, outdated infrastructure and an unstable baseload continue to pose challenges for South African producers, which has prompted the industry to explore renewable energy options in both mining and smelting operations.

Several South African producers have been developing and testing alternative energy-efficient smelting technologies, with African Rainbow Minerals ‘SmeltDirect’ being one example. Currently, Glencore and African Rainbow Minerals are pilot-testing SmeltDirect at one of Glencore’s smelters. The method is reported to use up to 70% less electricity than traditional smelting, significantly cutting operating costs and reducing reliance on Eskom. Merafe highlighted that retrofitting existing smelters with SmeltDirect could make them more competitive and environmentally friendly. Embracing such technologies, coupled with Glencore-Merafe’s renewable energy projects at their smelters, could enable South Africa to market a “low-carbon emission” ferrochrome product. If implemented, this could significantly lower operating costs and reduce reliance on Eskom, making South African ferrochrome more competitive. However, widespread adoption would require large investments, and without policy support or cost reductions, many smelters may struggle to justify the expense. The South African government has also explored policy interventions to support local ferrochrome production. In October 2020, it approved a chrome ore export tax in principle, aiming to encourage domestic beneficiation. However, the proposal has faced strong opposition from industry stakeholders, who argue that high electricity costs, rather than raw ore exports, are the primary challenge for ferrochrome producers. Critics warn that an export tax could make South African chrome ore less competitive internationally, potentially reducing overall export volumes and leading to job losses in mining. Without addressing the core cost challenges facing the sector, such policies may have limited impact.

A crossroads for the ferrochrome industry

The South African ferrochrome industry is at a turning point. Rising costs, weak prices, and logistical constraints are reshaping the sector, with more producers shifting towards chrome ore exports. While innovations like SmeltDirect offer potential cost savings, they require significant investment and policy support to become viable. At the same time, the government’s proposed chrome ore export tax remains controversial, with doubts over whether it can meaningfully reverse the industry’s decline.

The industry’s future will depend on its ability to adapt to changing market conditions, improve efficiency, and lower costs. Without significant reforms, further furnace closures and industry consolidation are likely, reducing South Africa’s role in the ferrochrome market and shifting more of the value chain overseas. Whether the industry finds a way to remain competitive or continues to decline will depend on how effectively these challenges are addressed in the coming years.

Join us at the ICDA Members Meeting 2025 in Ulanqab, China, on May 13-15

Project Blue is proud to partner with and support the International Chromium Development Association and its ICDA Members Meeting 2025.

The event will bring together the industry’s leading figures from around the world to a location which is key to China's ferrochrome industry, and is sponsored by Xin Gang Lian, with a technical site visit scheduled for May 13.

Project Blue's Senior Analyst Tanisha Grace Schultz will present our analysis of recent market developments and she will share our outlook for how the market is set to develop in the years ahead.

Learn more about the ICDA Members Meeting 2025, including how to register, by clicking here.