What’s behind the surge in tungsten prices?

News Analysis

2

Sept

2025

What’s behind the surge in tungsten prices?

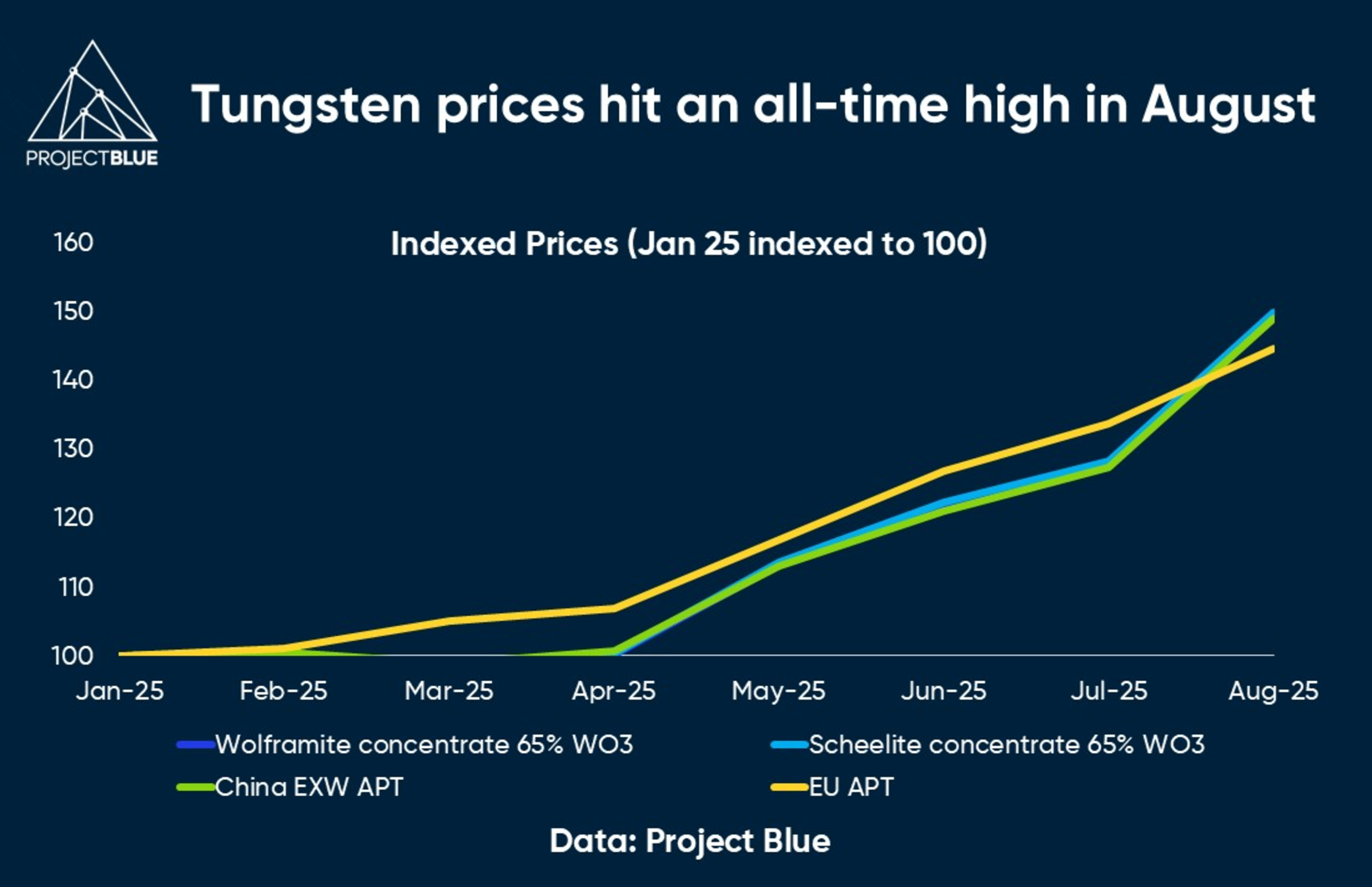

Tungsten prices soared to an all-time high in August as the market faces a supply shortage from China.

In August 2025, the monthly average Chinese 65%min WO3 wolframite and scheelite concentrate prices (ex VAT) approached the US$26,000/t mark, reflecting year-to-date gains to 50%. Notably, by 1 September both concentrate prices registered above US$32,000/t, up by 88% y-t-d. The recent surge in prices likely signals a broader structural change for tungsten pricing – with higher prices expected to remain.

The surge in raw material prices has cascaded into the intermediate tungsten market. The August monthly average, Chinese ex-works price (ex-VAT) for ammonium paratungstate (APT) reached US$381/mtu, up 49% y-t-d. The APT price on 1 September closed at US$470/mtu, up by 83% y-t-d. In Europe, the August average APT price reached US$496/mtu, representing a 45% increase since the start of the year. While European prices typically track Chinese levels at a premium, which grew in 2025. The Jan-Aug 2025 EU/China export APT premium averaged 3.2% vs 1.2% in 2024 over the same period, the increase is owed to China’s tungsten export restrictions, which were imposed in February.

The price performance in 2025 has been largely influenced by supply chain developments in China. While ex-China supply has been expanding, it is still insufficient to meet its own demand and remains reliant on Chinese material, which itself has been facing tighter availability. On top of this, demand growth, particularly from the defence sector, has exceeded expectations, adding further pressure to the market.

Chinese mine supply shortfalls and rising import activity

According to Project Blue, China produced around 67,000t W from its mines in 2024, broadly unchanged from the previous year and accounting for roughly 81% of global primary supply. Mine output is expected to edge lower in 2025, reflecting ageing operations and declining ore grades. Adding to these structural pressures, the Ministry of Natural Resources set the first batch mining quota for tungsten ore (65% WO₃) at 58,000t, down 4,000t from the same allocation in 2024. Several provinces, including Heilongjiang, Zhejiang, Anhui, and Hubei, received no quota, while Jiangxi, China’s largest producing province, saw its allocation cut by more than 2,370t. Hunan’s, China’s second-largest producing province, quota was left unchanged. Taken together, these factors could push Chinese mine supply down toward the 60,000t mark this year, providing continued support for elevated prices.

Adding to policy-driven supply discipline, China has sharply increased its imports of tungsten ores and concentrates over the last 18 months. In 2024, imports totalled 12,430t (gross), more than double 2023 levels and the highest on record. Strong demand continued into 2025, with customs data showing 9,402t (gross) imported between January and July, up 73% y-o-y. In 2025, Chinese imports were sourced primarily from long-standing suppliers Myanmar, North Korea, and Mongolia, with Kazakhstan emerging as a new and significant partner. Rising export volumes from these countries suggest that their production is also expanding.

These inflows are expected to soften potential domestic shortfalls, but China’s heightened buying is tightening feedstock availability in the international market, placing further pressure on an already constrained market. Typically, across commodity markets, a 6-12 month supply constraint can be managed through pipeline inventory, but beyond this timeframe, physical prices accelerate quickly due to genuine disruptions in material availability as even marginal players who may have been holding back physical materials have likely depleted their own stockpiles.

Kazakhstan (re-)emerges as a supplier

Kazakhstan re-entered the primary tungsten supply chain in 2025 after more than two decades without mine production. Over the past decade, its shipments were limited, peaking at just 84t (gross) in 2015, likely sourced from strategic stockpiles. The country has not exported significant tungsten volumes since the 1990s, when exports averaged around 1.1ktpy (gross) between 1997 and 1999, mainly destined for the USA.

In May 2025, Kazakhstan resumed bulk exports with 174t (gross), followed by sharp increases in June and July of 866t and 852t (gross), respectively. Although the official origin has not been revealed, the volumes suggest the material is likely sourced from the Boguty Tungsten Mine in the Almaty Region, with export levels consistent with expected ramp-up rates.

Export data shows that the entirety of Kazakhstan’s tungsten ore and concentrate shipments in 2025 were directed to China. At full capacity, the Boguty mine is expected to produce around 8,300t W, which, while a large operation, is only expected to offset China’s own domestic shortfall rather than add meaningfully to global tungsten mine supply.

China resumes tungsten product exports, but ex-Chinese prices stick

On 4 February 2025, China’s Ministry of Commerce and General Administration of Customs announced new export controls on tungsten, tellurium, bismuth, molybdenum, and indium. These controls are part of recent restrictions on the export of dual-use items, which can be used for both civilian and military purposes. The authorities stated that the restrictions aim to protect national security and fulfil international obligations, such as non-proliferation.

Following the introduction of export controls, Chinese exports of intermediate tungsten products declined sharply in February. Around 16 Chinese enterprises are licensed to export these products, each requiring a dual-use export permit. February’s shipments totalled 146t, consisting of 46t (gross) of bars and rods, 40t (gross) of tungsten carbide, 20t (gross) of APT, and 40t (gross) of tungsten oxide. There were no exports of APT, oxide, or carbide recorded in March, while bars and rods continued to be shipped.

In April, tungsten carbide exports resumed, though volumes were minimal at 8t (gross), before increasing through May, June, and July. APT and oxide shipments also resumed in June and July, indicating that export licenses had been granted. Despite the initially low volumes, the trade statistics do demonstrate that exports have restarted; however, the ability to re-stock sufficiently throughout the supply chain will likely remain severely restricted, and international intermediate tungsten prices should remain robust.

Our expectation is that prices will remain elevated, albeit slightly below the August/September highs. However, any further contraction in Chinese supply could trigger renewed volatility and sharp price swings.