USA bolsters downstream germanium refining capabilities for military applications

News Analysis

6

Feb

2026

USA bolsters downstream germanium refining capabilities for military applications

On 29 January 2026, the US Department of War (DoW) announced an investment of US$18.1M in Defense Production Act (DPA) Title III funding to 5N Plus (5N+). The initial announcement, which was intended for 15 December 2025, was delayed due to the US government shutdown.

Nearly three years after China first imposed export restrictions on germanium, a strategically important material, the US government has taken steps to establish alternative germanium supply chains for critical industries. 5N+ will utilise the funding from this investment to expand its germanium metal refining capacity sevenfold to 20tpy Ge at its St. George, Utah facility. This expansion will increase 5N+’s zone-refining capacity and backfill the germanium shortfall caused by China’s export ban.

This announcement follows Korea Zinc’s announcement on 15 December 2025 that the DoW and the Department of Commerce would jointly invest in the construction of an integrated smelter in Clarksville, Tennessee, with the capacity to produce approximately 44tpy Ge. In addition, Korea Zinc and Lockheed Martin announced a memorandum of understanding (MoU) in August 2025 to establish a 10tpy Ge recovery circuit at Korea Zinc’s Onsan smelter in Ulsan, South Korea. Although the Onsan germanium circuit is a relatively small facility, it is expected to offer some relief, but it is unlikely to move the needle in terms of the supply shortage.

Despite these initiatives, the USA will remain dependent on foreign suppliers to meet its germanium requirements until at least 2030, when the Clarksville facility is expected to commence germanium production.

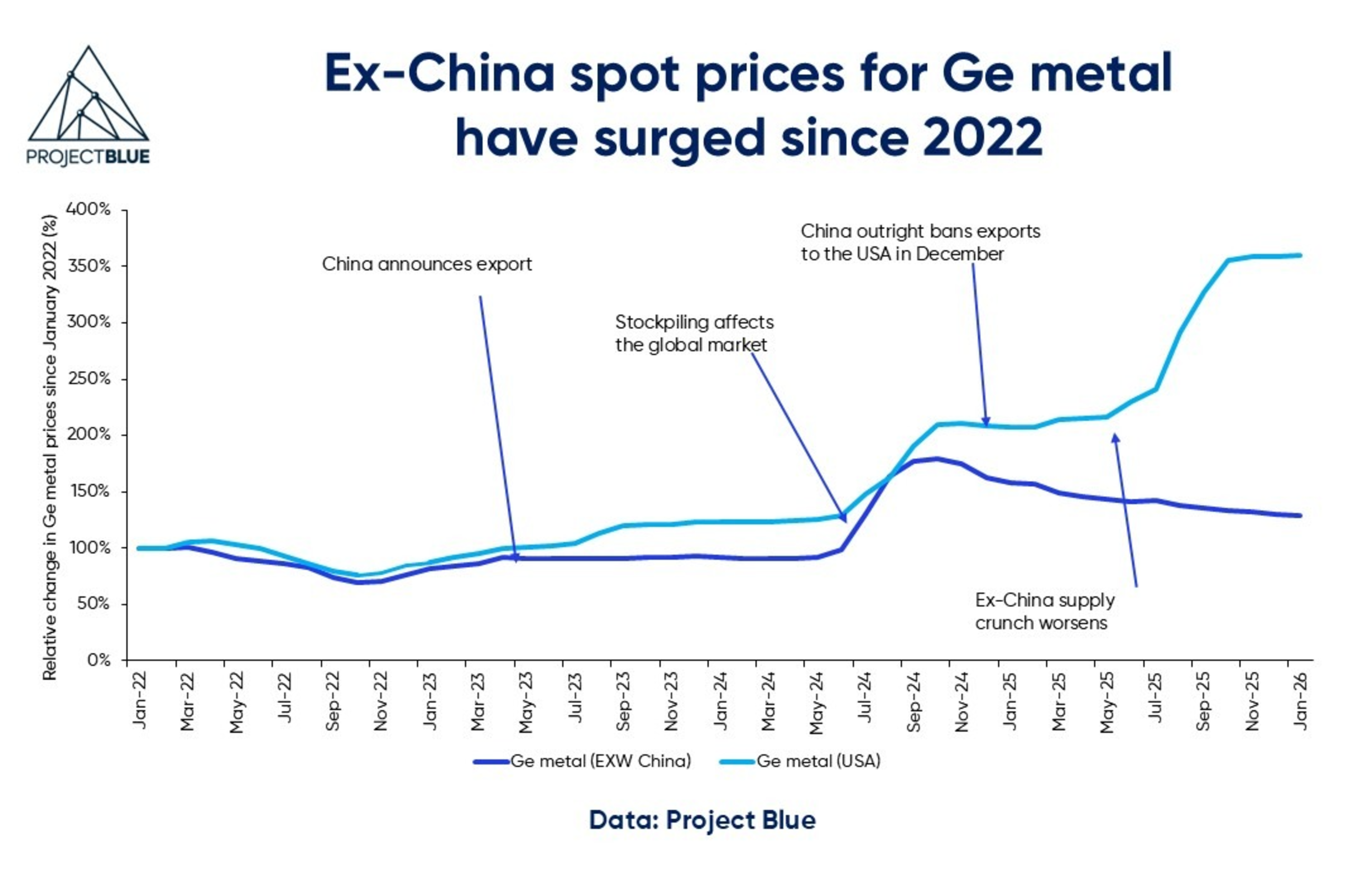

Nevertheless, the expansion of refining capacity (together with new sources of raw material) represents a welcome development for ex-China markets, which have faced acute shortages of germanium feedstock for more than two years. Ex-China spot prices have surged to approximately US$5,000/kg Ge, up from around US$1,300/kg Ge in 2022, underscoring the severe scarcity of freely available material.

Conversely, domestic EXW China germanium prices have declined for nearly 14 consecutive months, with only a single month recording a modest increase of approximately US$3/kg. This divergence highlights the pronounced oversupply within the Chinese domestic market, even as consumers outside China continue to face significant feedstock constraints.