Copper mining on “the roof of the world” - Tibetan Plateau

Opinion Pieces

13

Jan

2025

Copper mining on “the roof of the world” - Tibetan Plateau

On 6 January, the China Geological Survey announced a new discovery of copper reserves located in the Tibetan plateau. The latest discovery adds to the plateau’s already substantial reserves. Since 2021, the Plateau has accumulated more than 20Mt of new copper resources, with a predicted resource potential of 150Mt, making it among the world’s largest copper resource bases by volume.

Tibet is growing as an important copper mining region for China. Copper concentrate production in the area has surged in recent years, largely benefiting from the commissioning of Zijin’s Julong mine in late 2021 and the expansion of Western Mining’s Yulong mine since 2020. Project Blue estimates that China produced 1.67Mt of copper-in-concentrate in 2024, with Tibet accounting for 22%.

Source: Project Blue, company filings

Project Blue estimates that there are three advanced copper projects currently in development, aiming to unlock more copper production in Tibet over the next few years. Zijin expects to complete the construction for Julong phase II by the end of 2025, increasing the mine’s capacity from 160ktpy to 350ktpy Cu, making Julong the largest copper mine in China. Zijin is also developing the greenfield project Zhunuo, aiming to bring the mine online by mid-2026. We expect Zhunuo to produce around 80ktpy Cu at full capacity.

With its current capacity approaching 160ktpy Cu, the Yulong mine has the potential to expand further to 200ktpy after its Phase III expansion. Western Mining is likely to go ahead with the expansion in 2025 should the supply tightness in copper concentrate continue. These developments can enable China to add over 300ktpy Cu to domestic mined copper production by 2028 (the equivalent of a Las Bambas mine), helping to reduce China’s dependence on imported feeds.

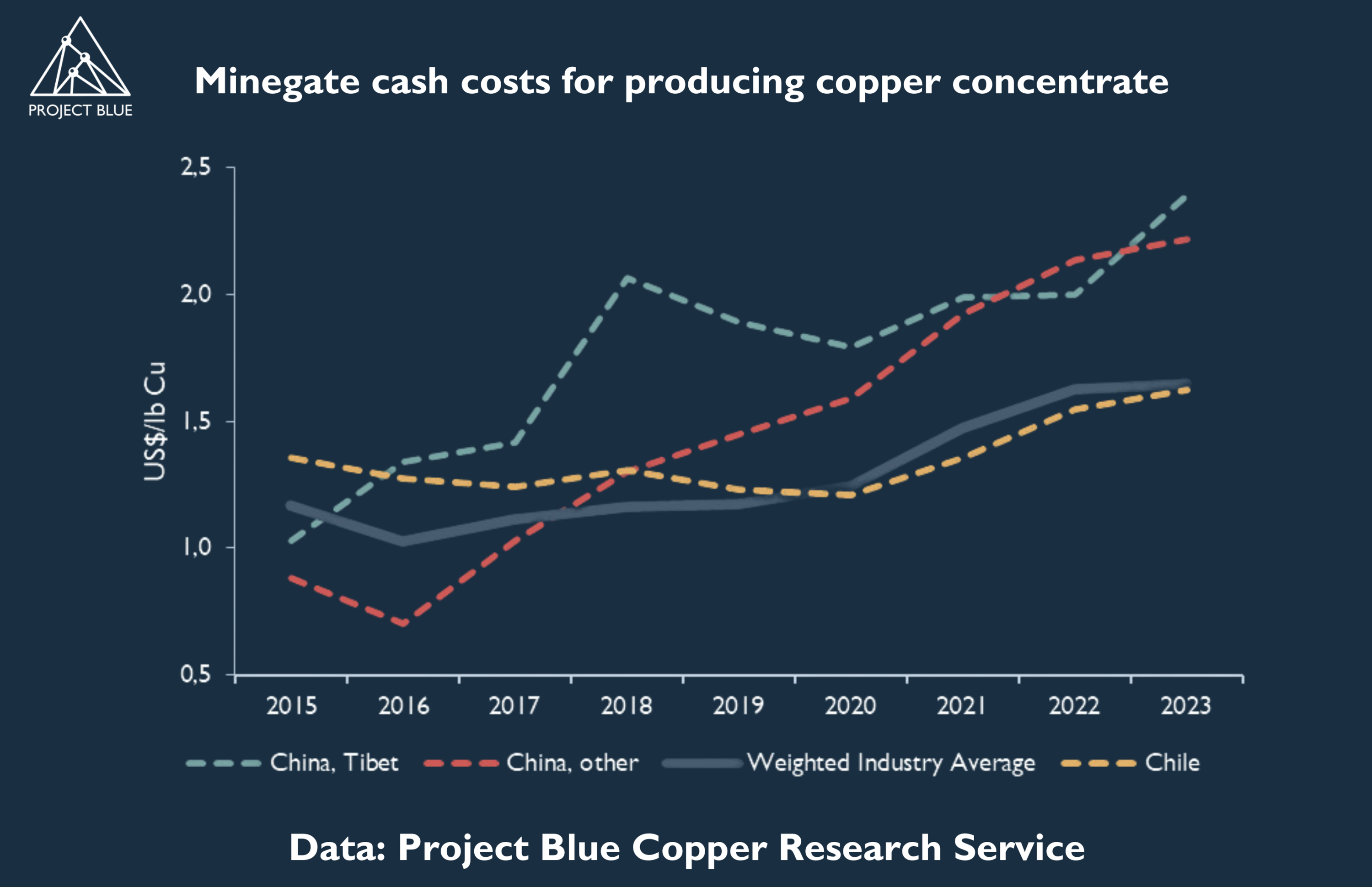

Despite the great resource potential, the challenge of mining copper in Tibet is huge. Mining sites for Julong, Yulong, and Jiama are all 4,000m above sea level. Such high altitude, coupled with complex geological conditions, make any operational activities challenging, in turn, pushing mining costs high above the industry average. While expansions and retrofitting at existing operations have brought costs down in recent years, Tibetan assets remain less cost competitive than domestic Chinese and South American peers.

Project Blue estimates that the average minegate cost for Tibetan assets sits north of US$2.40/lb Cu, compared to US$2.20/lb Cu for other Chinese assets. On a global scale, this cost level is far above the industry average of just US$1.60/lb Cu, highlighting the cost pressure for Tibetan assets. Conversely, Chilean operations managed to control their costs in line with the global average despite persistent challenges. managed to control their costs in line with the global average despite persistent challenges.

ESG concerns could be another major caveat for Tibetan copper projects aiming to materialise. One recent example is Jiama’s mine tailings spill accident in March 2023, which led to an 8 month production suspension and cost blowout. As such, Jiama’s production levels have plunged by 76% year-on-year in 2023 and remained 53% lower than its 2022 level in 2024. We estimate Jiama’s All-in Sustaining Costs rose to over US$4.31/lb in 2023, more than double from 2022. We believe that Jiama’s production level is unlikely to return to its designed capacity of around 100ktpy Cu before the new tailings dam becomes operational in 2027.

It is reported that by December 2016, the Duolong Mining Area in Tibet has a total proven copper resource of 13.5 Mt Cu with ore grades averaging 3.8% Cu, making it similar in size to China’s largest operational copper mine – Dexing, with much higher grades than the average of existing Chinese operations (0.42% Cu). It might seem counterintuitive as to why this mine has yet to be developed considering China’s hunger for copper raw materials in recent years.

The dilemma mainly arises from the fact that Duolong sits just next to a national nature reserve called Qiangtang. It covers an area of 334,000km2 as part of the local alpine ecosystem and is also the home to many rare animals including wild yaks and Kiang. Therefore, the development of Duolong is not only a technical issue, but there is also a big question of how to strike a balance between the mine’s economic benefits and ESG consequences over the longer term.

Source: Project Blue Copper Extractive Cost Tracker.

Note: Minegate CashCosts (on a co-product basis) include mining costs, processing costs, G&A costs and royalties.