Boeing caught up in USA–China tariff war

Opinion Pieces

17

Apr

2025

Boeing caught up in USA–China tariff war

Amid the ongoing trade war with the USA, China’s airlines are halting orders of Boeing aircraft and related parts from US companies.

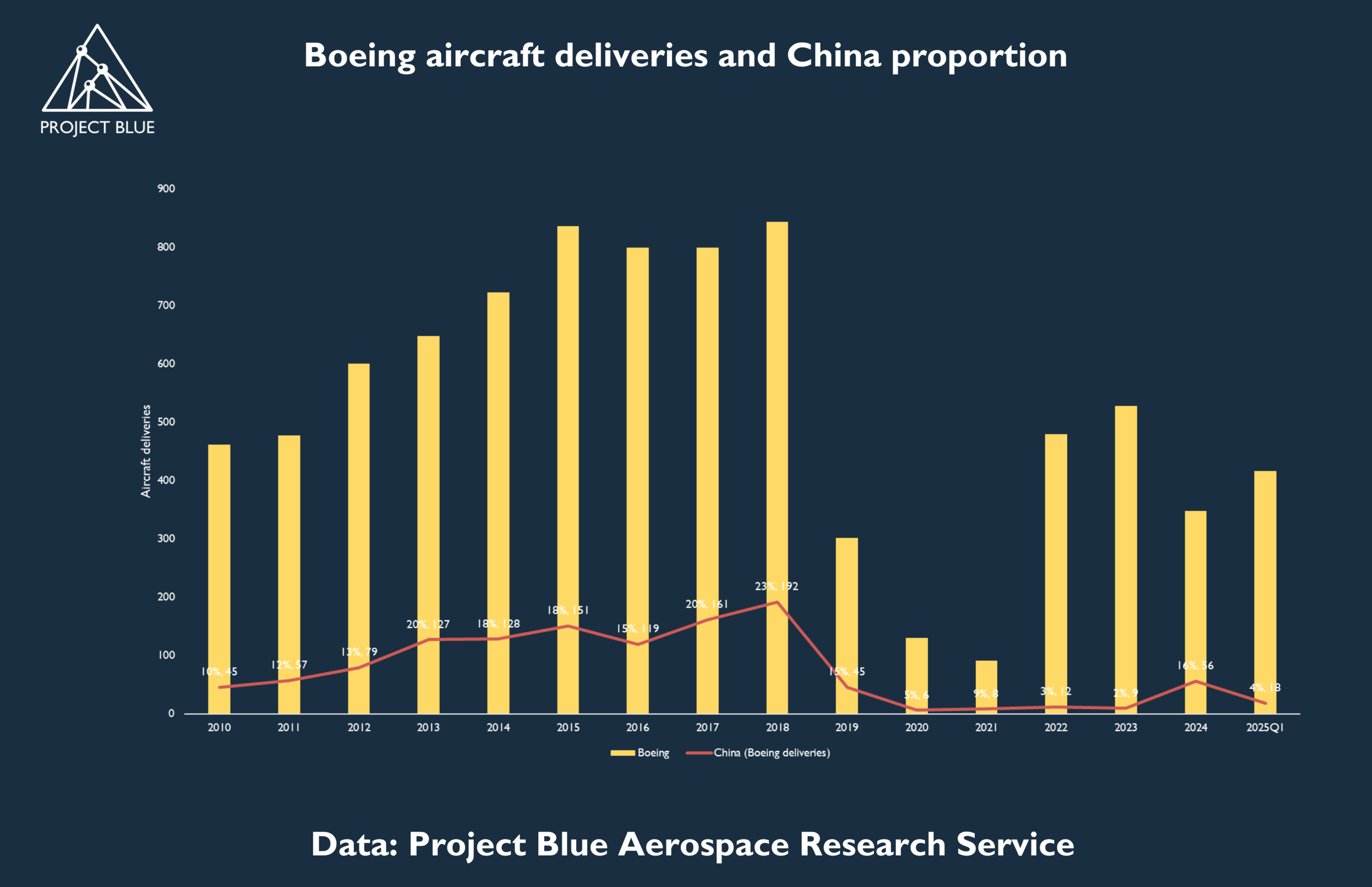

The aerospace industry has evolved into a duopoly between Boeing and Airbus, each capturing around equal market shares just prior to 2019 when two fatal Boeing 737 MAX crashes kickstarted a series of safety concerns within Boeing’s supply chain—and the aerospace industry as a whole. While both OEMs navigated the COVID-19 downturn, Boeing’s market share fell below 40% in 2022 and 2023 before losing even more ground in 2024, plummeting to less than 30%.

The move by China to limit Boeing aircraft for its airlines jeopardises more than US$1.2Bn in orders and further complicates Boeing’s recovery from recent safety issues and FAA-imposed 737 MAX production caps. In 2024, Boeing delivered 348 aircraft, compared to 766 by Airbus, with 56 Boeing jets going to China. Both Boeing and Airbus have established assembly lines in China, with the Asian market forecast to offer the greatest upside in orders. Airbus delivered its first improved fuel efficiency and performance NEO series plane in January 2016 as part of its Asia market strategy, with Boeing accelerating the development of its competing model, the MAX, to deliver it one year later in May 2017.

Another important thread from China’s perspective is its own aerospace programme through the Commercial Aircraft Corporation of China (COMAC). COMAC delivered its first active duty C919 aircraft in 2022, designed to compete with the NEO and MAX. Although COMAC remains several years away from achieving full-scale competitiveness and must still partner with jet engine OEMs while the CJ-1000A turbofan engine remains under development (currently using the LEAP engine from CFM International), it stands to benefit substantially from government protection and preferential procurement policies. Such support would enable the company to make meaningful progress in challenging the established aerospace duopoly.

In the short term, Airbus stands to benefit from increased market share opportunities, which would also filter through to Rolls-Royce as one of its preferred engine OEM partners. Airbus, however, is not in the clear, with one challenge alone being the reported difficulties in securing enough CFM International jet engines, which are also used by Chinese airlines.