Lake Resources aims to increase value of the Kachi project

Opinion Pieces

7

May

2025

Lake Resources aims to increase value of the Kachi project

The ASX-listed developer has stated it believes that the value of its Argentinian lithium project is “materially undervalued” by the market as it looks to increase the projects value, eyeing a future sale.

Lake Resources has announced an “exploration of strategic alternatives” as it looks to reduce the gap between what it estimates the Kachi asset should be valued at, and valuations on the open market. These alternatives include a possible partial sale of Lake Resources’ interest in Kachi, a merger or sale of the company, and various restructuring initiatives and joint ventures with other battery raw material players. The company has cited other Argentinian lithium projects that were sold with values exceeding market valuations as its justification for the undervaluation opinion.

There have been several examples of Argentinian brine projects being sold or considered for sale in recent years. The highest profile being Rio Tinto’s acquisition of Arcadium Lithium, which included several Argentinian brine operations and projects. Valuations of lithium projects have been hampered by the current lower lithium pricing environment though this has not stopped premiums being paid for lithium projects and companies developing them. With Project Blue forecasting lithium demand to grow by 10.3% CAGR over the next 10 years, the potential for M&A activity in the lithium space remains high with sellers looking to maximise their asset values ahead of perceived increases in future pricing of lithium products.

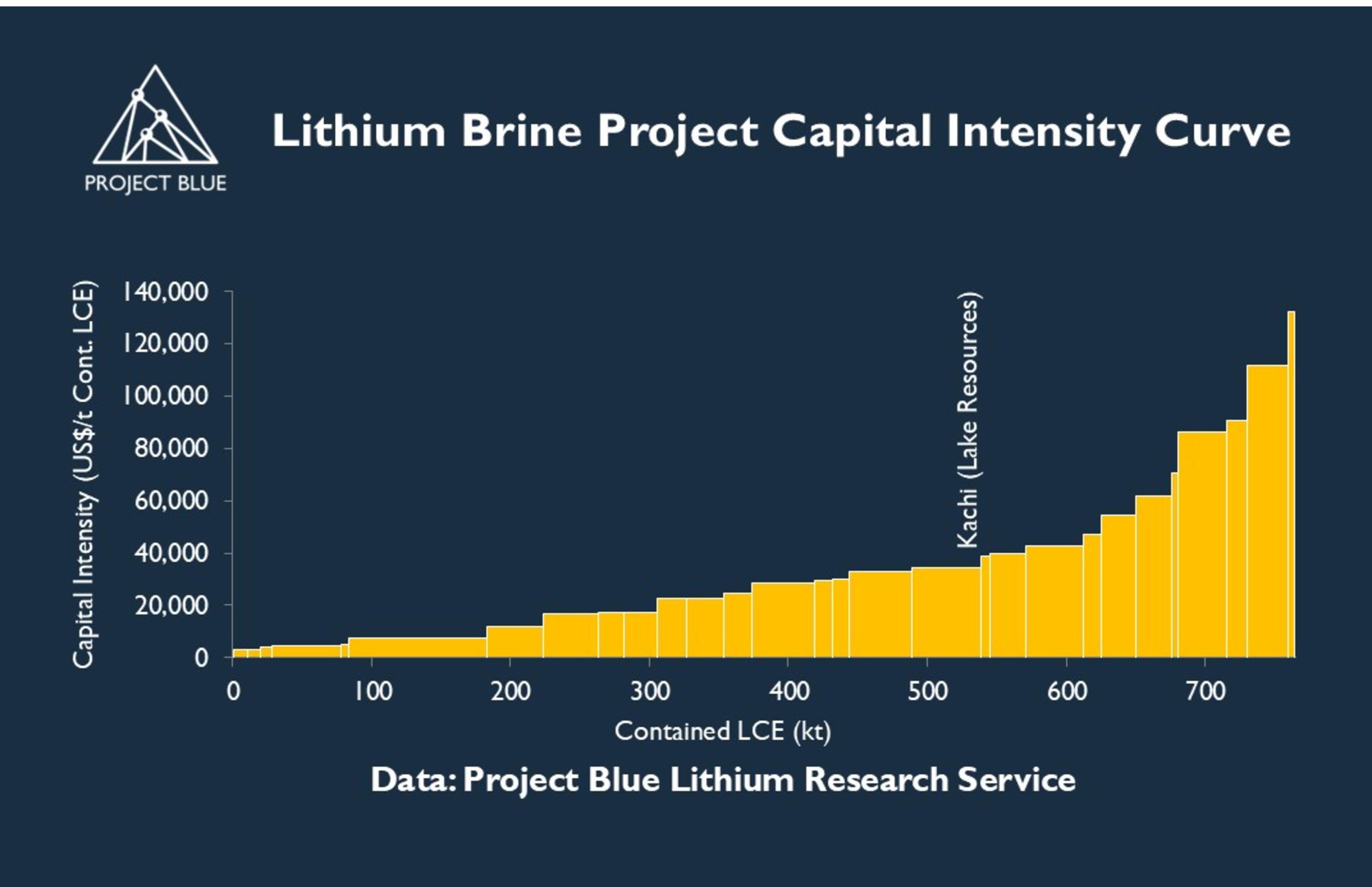

Project valuations are determined by a number of factors, including life of mine revenue generated and initial capital construction costs.

As analysed by Project Blue, the Kachi project has a capital intensity of just under US$35,000/t LCE, placing it in the third quartile of the lithium brine capital intensity cost curve. The project is aiming to produce lithium carbonate, which Project Blue forecasts to be trading at a premium to lithium hydroxide over the next decade. It is also being developed in a jurisdiction with favourable mining-oriented national policies. However, with oversupply in the market and a muted uptake of electric vehicles forecast to suppress lithium prices over the next decade, this will reduce the valuation of all prospective lithium projects – including Kachi. In an oversupplied market, future supply is more likely to come from existing producers which benefit from lower capital intensities, lower capital risks, and faster ramp up periods. This shrinks the number of projects with favourable internal rates of return that investors would look to develop. While Kachi has a number of favourable fundamentals, the question will be whether investors believe lithium prices are under-forecast, or if the Kachi project is able to reduce its capital intensity and operating cost.