Tariffs eased; jets cleared: a global reset for aerospace markets

Opinion Pieces

14

May

2025

Tariffs eased; jets cleared: a global reset for aerospace markets

As the USA strikes new trade deals with the UK and China, the easing of tariffs is reviving aircraft deliveries, reducing supply chain friction, and providing the global aviation industry with a much-needed boost.

Two recent trade developments, the signing of a US–UK agreement and a temporary tariff truce between the USA and China, are set to influence the global aerospace industry, particularly in terms of supply chains, cross-border investment, and aircraft deliveries. Both agreements ease trade restrictions that have impacted civil and defence aviation, with potential implications for key industry players such as Boeing, Rolls-Royce, and Airbus.

Key provisions from the US–UK deal include the removal of US tariffs on UK steel and aluminium, with most remaining tariffs capped at 10%. In return, the UK has lowered its average tariffs on US goods from 5.1% to 1.8%. Critically, aerospace-specific components, such as engines and precision parts from Rolls-Royce, will now enter the USA tariff-free. This change is expected to reduce production costs for US manufacturers and offer greater sourcing flexibility across the transatlantic supply chain.

Coinciding with this agreement is an estimated US$10Bn order from British Airways’ parent company, IAG, for 32 Boeing 787-10 Dreamliners. This order adds to an existing UK backlog of 149 Boeing aircraft. IAG also ordered 21 Airbus A330-900neos, indicating balanced fleet diversification. The scale and timing of the Boeing purchase suggest reinforced transatlantic ties and an enhanced export outlook for US aerospace firms in a post-Brexit environment.

The defence sector also stands to benefit. A partial exemption from US arms export rules will streamline the trade of military aerospace components, likely supporting firms such as Rolls-Royce and enabling closer collaboration on joint projects.

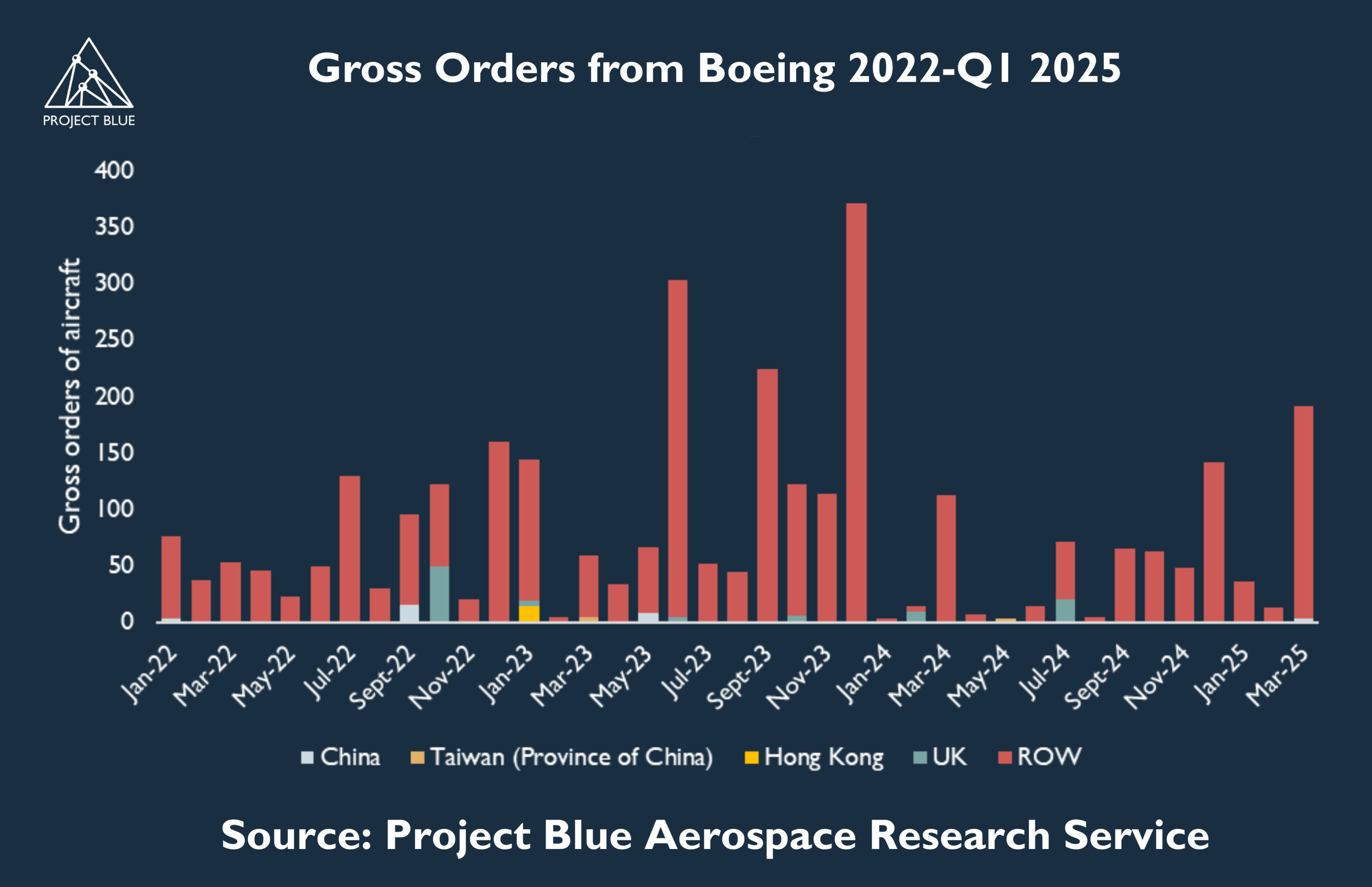

Meanwhile, the USA and China have agreed to slash reciprocal tariffs temporarily, some previously exceeding 100%, during a 90-day negotiation period following talks in Geneva. As part of this easing, China has lifted its ban on Boeing aircraft deliveries, which were paused in April due to earlier trade tensions during which several aircraft were returned from Boeing’s delivery centre in China, and the company had reportedly begun exploring alternate buyers for undelivered jets.

With China representing around 10% of Boeing’s commercial backlog, the reopening of deliveries may affect production schedules and inventory levels. Boeing plans to deliver 50 jets to Chinese carriers in 2025, with 41 already built or in production. Of these, 25 are 737 MAX aircraft built before 2023 that had not yet been delivered. Prior to the announcement of this trade-truce, China Airlines placed a firm order for 10 777-9 passenger jets and four 777-8 freighters, with additional options to purchase five 777-9s and four 777-8 freighters, with four freighters already in production from an order placed in 2022. Access to the Chinese market may temporarily support global aerospace supply chains disrupted by previous delivery suspensions. Resumed deliveries could ease Boeing’s inventory pressure and reactivate affected parts of the aerospace supply chain.

.png)

These developments come as Spirit AeroSystems is advancing with the divestiture of specific aerostructure assets to Airbus while concurrently preparing for acquisition by Boeing, indicating ongoing structural transformations within the aerospace manufacturing sector. The targeted acquisition by Airbus and the broader takeover by Boeing of Spirit AeroSystems are anticipated to be finalised in Q3 2025, subject to regulatory approvals. These actions represent a coordinated effort by the two leading aerospace companies to mitigate supply chain vulnerabilities associated with Spirit AeroSystems’ pivotal role in commercial aircraft production.

While the longer-term effects of these trade agreements remain to be seen, they represent notable shifts in aerospace trade policy. The short-term outcomes may include adjustments to procurement strategies, logistics planning, and supply chain realignment across both the commercial and defence sectors.