How will China’s new electricity policy reshape the future of the country’s vanadium redox flow battery market?

Opinion Pieces

19

May

2025

How will China’s new electricity policy reshape the future of the country’s vanadium redox flow battery market?

Two landmark policy releases in early 2025 have signalled a structural shift in China’s electricity and energy storage landscape—from state-mandated deployment, to market-oriented optimisation. This change presents a significant cost-reduction challenge for the country’s vanadium redox flow battery (VFB) sector.

On 9 February, the National Energy Administration released the ‘Notice on Deepening Market-Oriented Reform of Renewable Energy Feed-in Tariffs to Promote High-Quality Development’, eliminating mandatory energy storage allocations for new renewable projects. Following this, on 29 April, China issued the notice on Accelerating the Comprehensive Development of Electricity Spot Markets (NDRC Reform Office [2025] No. 394), mandating full coverage of electricity spot markets by end-2025. It reinforces price-based resource allocation and encourages flexible assets—such as energy storage—to participate in real-time markets and ancillary services.

Together, both policies send a clear signal: China’s energy storage sector is entering a new era where market forces, not policy mandates, determine viability. In Project Blue’s view, this shift will catalyse a period of painful adjustment for the Chinese VFB sector in the near term, followed by a longer-term phase focused on structural cost reduction.

In the short term, the removal of storage mandates is expected to accelerate consolidation across the VFB industry. Small and medium-sized enterprises, previously reliant on policy incentives and subsidies, will be exposed to heightened risks—including order cancellations, unsold inventory, and liquidity shortfalls. As a result, low-efficiency production capacity is likely to exit the market, and technologically outdated storage products will become rapidly obsolete. Market share will increasingly concentrate around players with superior technology, proven system performance, and scalable business models.

In the long term, the shift to market-based pricing and competitive service models will compel VFB producers to address their most significant structural weakness: cost. As of 2024, average four-hour VFB systems were priced at around RMB 2.4/Wh, with the lowest reported figures around RMB2.02/Wh—still approximately four times higher than equivalent lithium-ion battery systems, which range from RMB0.5 to 0.6/Wh, with some as low as RMB0.3/Wh. This cost gap severely limits VFB competitiveness in short-duration storage segments and forces a strategic pivot towards long-duration applications where lifecycle advantages—such as 15,000 to 20,000 cycles and intrinsic safety—can be better monetised.

To overcome high-cost challenges, the market is already responding with innovations. One development is the emergence of hybrid systems that combine VFBs with lithium-ion or hydrogen technologies to balance short- and long-duration needs. These configurations offer both technical and economic optimisation for complex grid applications. In parallel, new business models—electrolyte leasing—are being trialled to reduce the upfront capital burden on project developers. Moreover, domestic firms like Guoneng Energy Storage are investing in R&D to localise key components, with the aim of narrowing the cost gap and improving supply chain resilience.

However, the most direct and significant lever for cost reduction lies in the vanadium electrolyte itself. Electrolyte accounts for roughly 40% of total system costs, with vanadium pentoxide (V₂O₅) contributing approximately half of that. However, the potential for further cost cuts appears limited. Pangang Group Vanadium & Titanium Resources, despite being a vertically integrated producer with low-cost vanadium supply and a 16kt offtake deal with leading VFB manufacturer, Dalian Rongke Power, saw its vanadium products‘ gross margins drop from 27.5% in 2023 to just 10.4% in 2024. This suggests that further reductions in material costs may be increasingly difficult to achieve, raising doubts whether VFBs can close the price gap with lithium-ion batteries through electrolyte cost control alone.

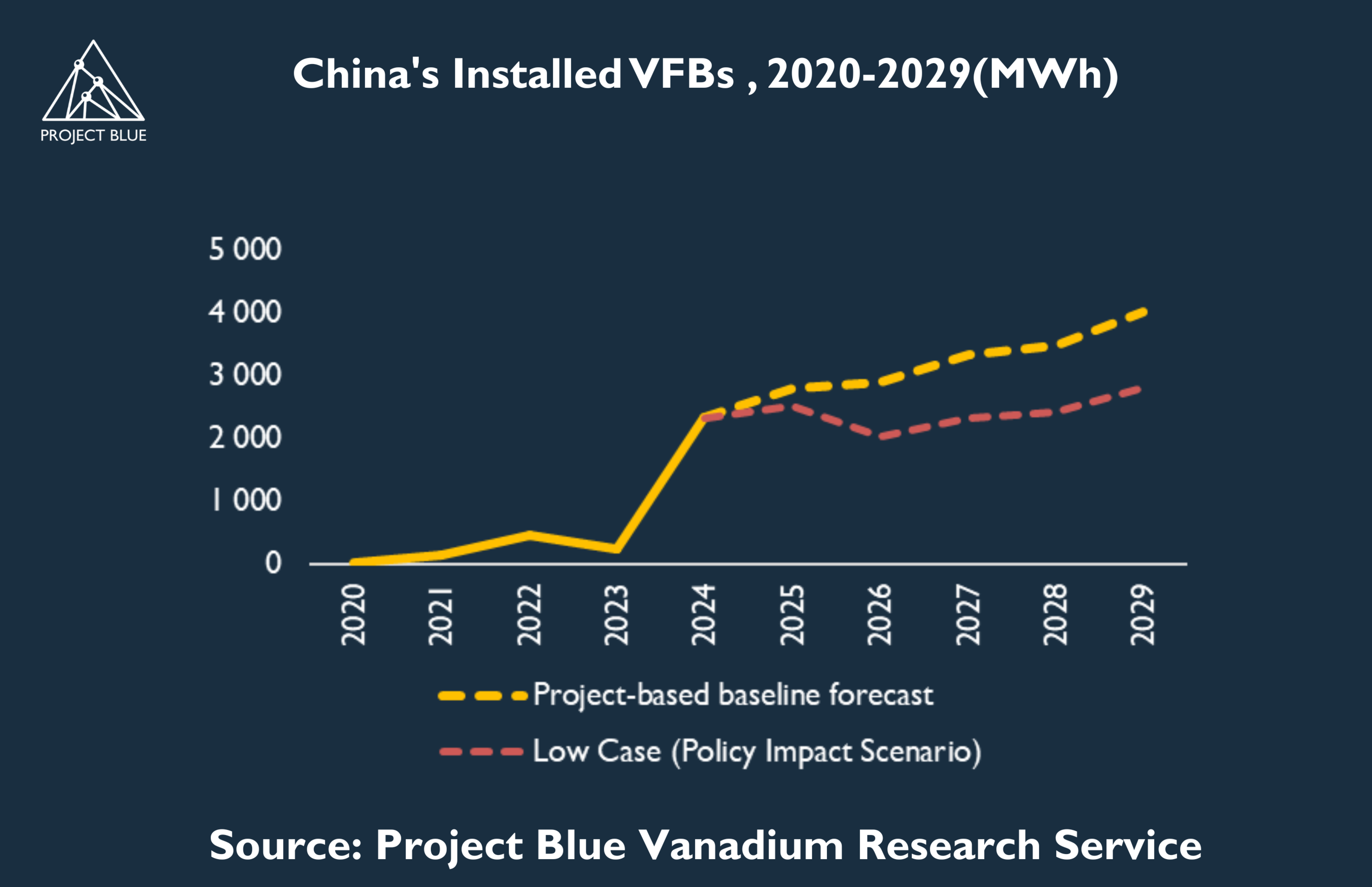

China’s VFB sector now stands at a critical inflection point. Previous growth cycles were largely policy-driven, but future success will depend on the industry’s ability to innovate, localise production, and respond with commercial agility to a market-driven environment. Globally, China is expected to remain the largest market for VFB projects. However, the strong growth momentum observed since 2022 is likely to moderate as the domestic market shifts from policy-driven expansion to market-oriented dynamics.

.png)