What are the ripple effects of the DRC’s cobalt export ban?

Opinion Pieces

26

Aug

2025

What are the ripple effects of the DRC’s cobalt export ban?

The global cobalt market has shown signs of structural change. Surging feedstock supply, coupled with slowing demand growth, has resulted in continuous price declines since mid-2022. Due to a widening surplus across all cobalt product markets, the spot cobalt metal price tumbled to below US$10/lb at the beginning of 2025, the lowest level seen in nearly a decade.

On 22 February 2025, the Democratic Republic of the Congo (DRC) government imposed a four-month cobalt export ban in response to a sustained period of low prices and oversupply. On 21 June 2025, the ban was extended for a further three months, “…due to the continued high level of stock on the market”. The main goal of the ban for the DRC government is to stabilise falling prices, encourage domestic processing, and gain more control over its strategic cobalt resources.

How is the export ban affecting the global cobalt market?

A ban on cobalt exports in 2025 is unprecedented, as it is the first formal export ban on cobalt imposed by the world’s largest producer—the DRC. Project Blue expects the country alone will account for around 65% of global production in 2025. Given that previous export restrictions all had a multi-commodity focus (on both copper/cobalt ores and concentrates) and that the implementation was selective (by granting waivers to certain producers), this is the first time a nationwide blanket ban has been enforced by the DRC on cobalt, targeting all exports of unrefined cobalt.

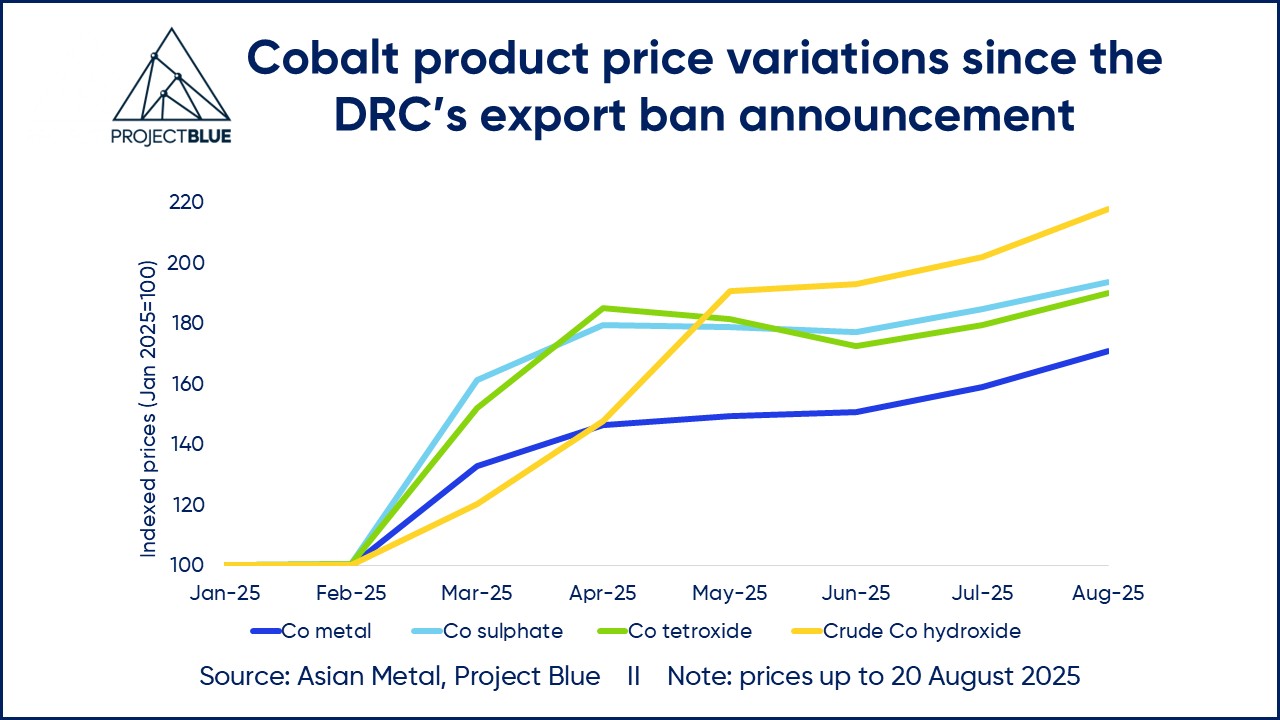

The result has been a spike in prices across all cobalt products. Since the February announcement, the price of crude hydroxide has more than doubled. Furthermore, price levels for key battery materials such as cobalt sulphate and tetroxide both hit multi-year highs by late August. Given that ample stocks still overhang the market outside the DRC, price reactions so far have been largely driven by sentiment and speculation rather than by fundamentals.

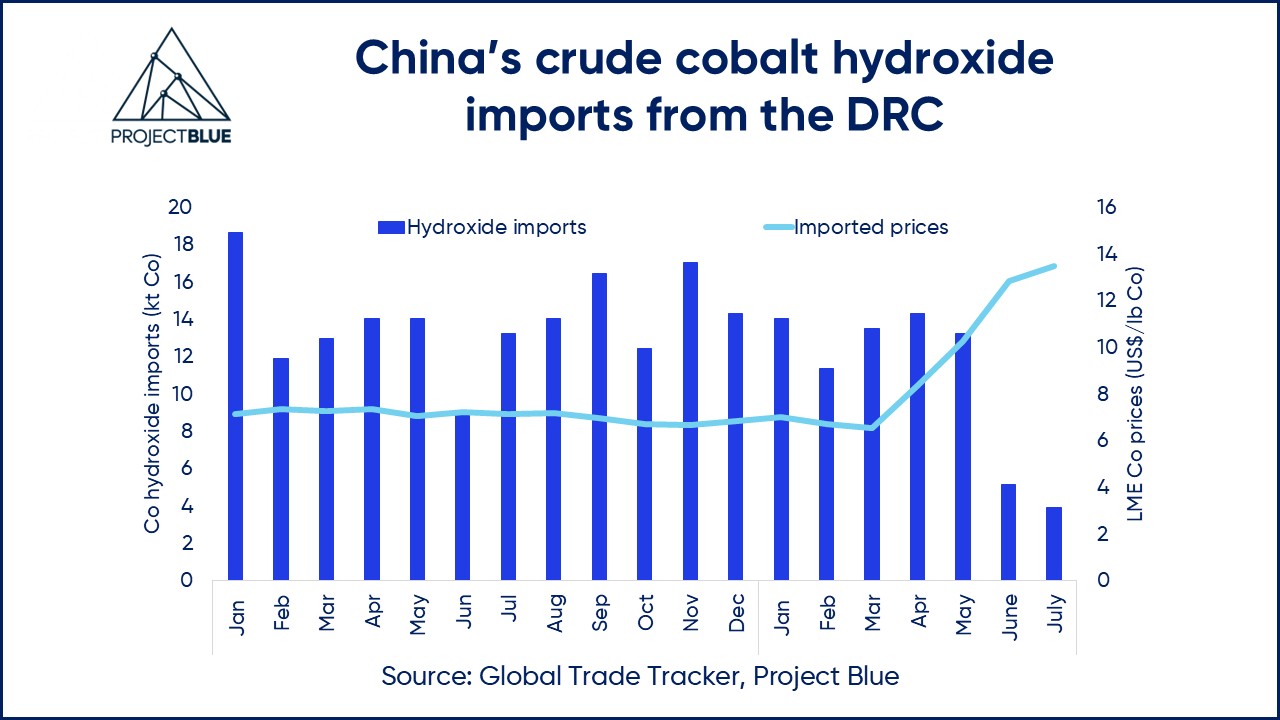

However, the hydroxide spot market is showing signs of growing tightness. Due to the continuous drawdown in stocks outside the DRC, refineries in China, as the primary consumer of Congolese hydroxide units, are operating at lower capacity utilisation rates and increasing their usage of MHP and recycled materials during the production process. This trend has already been evidenced by plunging hydroxide imports recorded in June and July, down 61% and 32% m-o-m, respectively.

As a result of the ban extension, we expect to see a continuous decline in imported hydroxide volumes for the remainder of 2025, considering a typical transportation window of two to three months for Congolese cobalt shipments into China. Hydroxide stocks currently held in warehouses across South Africa, Zambia, and Malaysia may also serve as top-up feeds for refineries over the next couple of months to support production. Therefore, should any export restrictions remain in place, a potential shortage in the feedstock market is highly likely to occur around November or December.

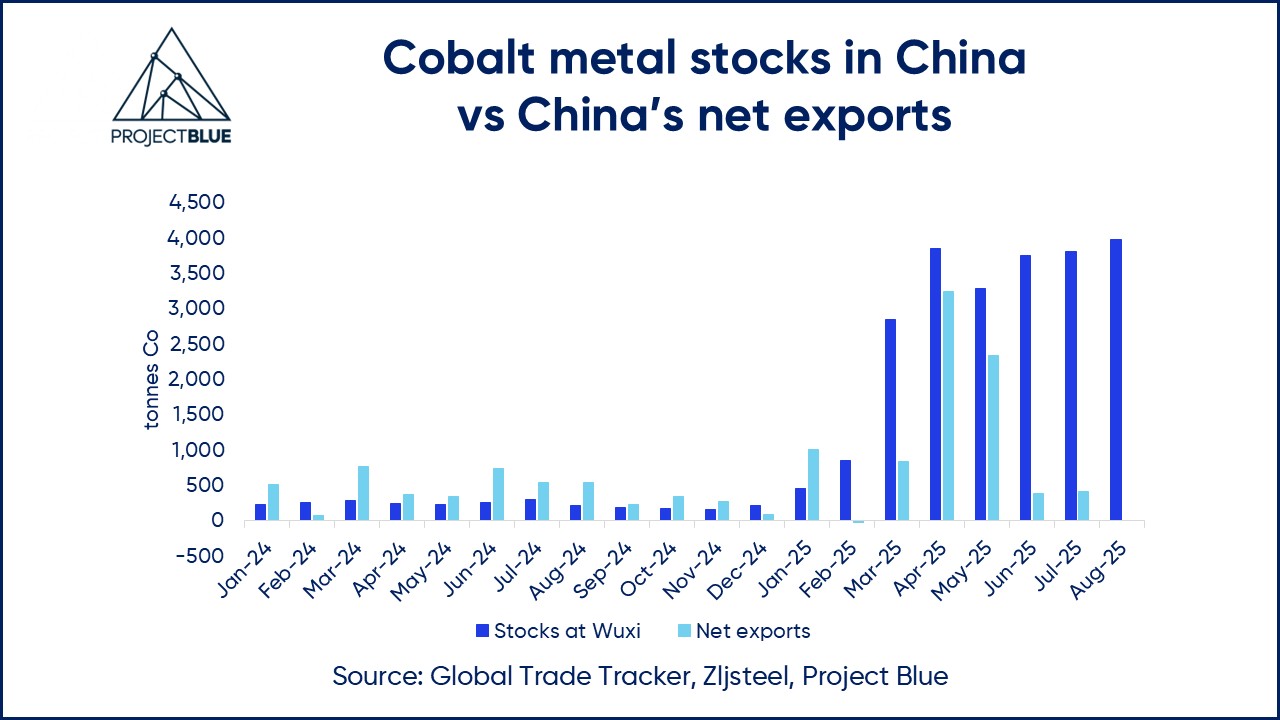

On the contrary, cobalt metal stocks in China have reached record highs so far this year owing to excess supply. Project Blue estimates that total metal stocks in China stood at around 8kt in mid-August, including physical stocks at the Wuxi Exchange and from bonded warehouses. With monthly production stabilising at around 2kt, the metal market is sufficiently supplied.

Net cobalt metal exports have also surged to unprecedented levels this year as the price increase following the ban incentivised Chinese producers to export more metal to capitalise on higher margins. The sharp decline in net exports in June and July, however, suggests more cautious selling practices by producers and increased stockpiling activities for metal amid feedstock tightness.

It is interesting to highlight that metal stocks could be the last resort for refineries should available feedstock fall to critically low levels in the coming months. If refiners can secure relatively low purchasing prices for metal material, such conversions could turn out to be economically viable, particularly when coupled with a return of the sulphate premium. However, nearly all metal stocks in China are in the form of cut cathode, which is often not as favourable as other metal forms, such as powder and briquette, for the production of sulphate, given that its low surface area typically results in slower dissolution and requires extra handling.

Will Indonesian supply be able to fill the gap?

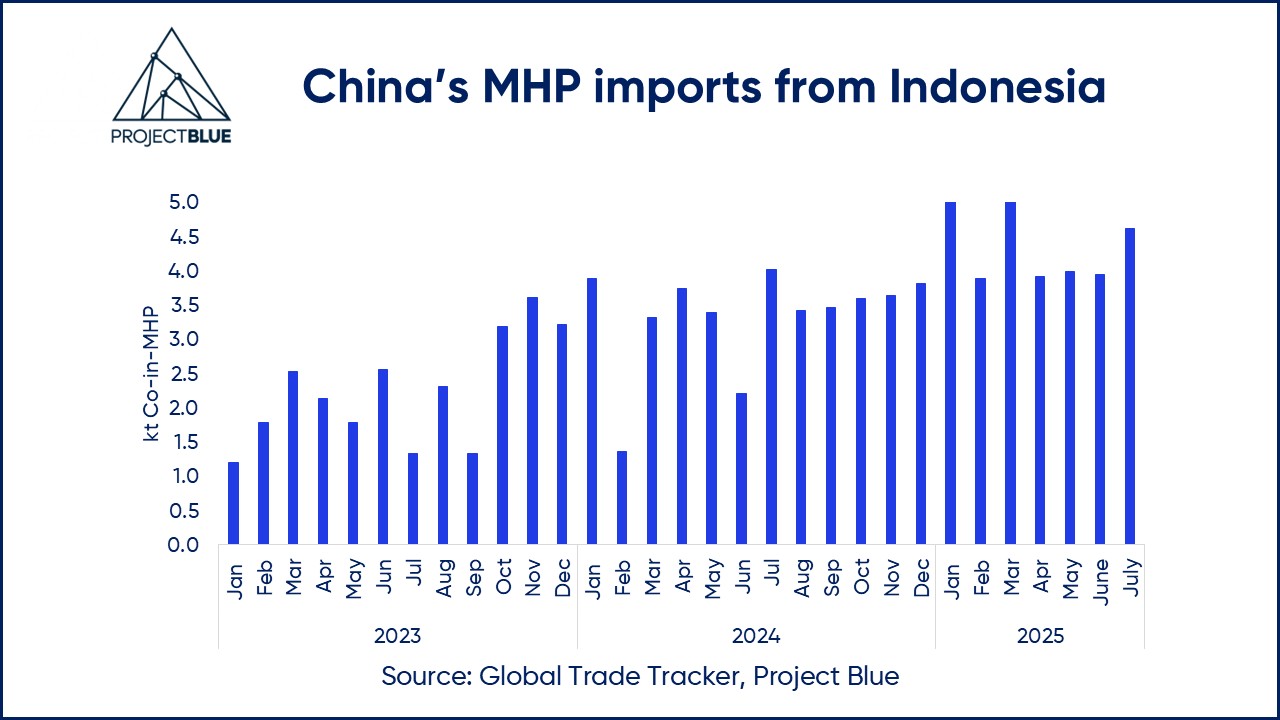

Despite starting from a low base, Indonesia has grown rapidly, becoming an important cobalt supplier in recent years, benefiting from the surging supply of nickel–cobalt mixed hydroxide precipitate (MHP). Project Blue expects Indonesian MHP production to exceed 50kt in 2025, accounting for around 17% of total intermediate supply.

This year, MHP is gaining more popularity among nickel and cobalt refiners. The NPI–matte–nickel sulphate production route has been uneconomical since mid-2024, and especially in 2025, due to elevated NPI prices and weaker nickel sulphate prices. MHP has instead stepped in as a more cost-effective alternative. It can be directly leached into nickel and cobalt sulphates, providing refiners with two revenue streams from a single feedstock source, in turn, cutting costs and energy use.

As a result, between January and July 2025, China’s MHP imports from Indonesia rose sharply to around 31kt on a contained cobalt basis, up by 40% y-o-y. Driven by the strong purchasing appetite of refiners and limited matte availability, the MHP market has remained tight in recent months, with cobalt payables currently firming up in the 70–75% range.

Project Blue expects strong Indonesian MHP supply growth to continue in 2026, driven by the ramp-up of PT ESG, PT Meiming, and PT Green Eco (fully operational by then), as well as the addition from PT ENC and Blueflame’s projects, should they be successfully commissioned by 2026. The project pipeline and previous ramp-up schedules tracked by Project Blue suggest that MHP production capacity in Indonesia could potentially total over 110kt Co by 2030.

Medium-term MHP growth will continue to be supported by the active development of high-pressure acid leach (HPAL) projects in Indonesia, with the government’s recent royalty reform favouring MHP production. While royalties for nickel ores and Class II nickel were raised steeply (to 14–19% and up to 7%, respectively), MHP and other refined nickel products were given a low, flat royalty rate range of 1.5–2.0%. This provides a fiscal incentive to move downstream into MHP production via HPAL, rather than remaining at the ore mining or NPI/matte smelting stages.

Despite significant growth potential, bringing new MHP supply online is becoming more challenging. There are a few major caveats that could delay HPAL development in Indonesia in the coming years. First, surging demand from the fertiliser and expanding nickel processing sectors triggered a spike in sulphur prices this year, which, in turn, has resulted in a sharp increase in production costs for HPAL operations in Indonesia. Considering that sulphuric acid typically accounts for around 40% of total OPEX for such operations, elevated sulphur prices, coupled with low nickel prices, could keep new investment in check.

Second, ore availability could be another constraint. In Indonesia, more than 65% of nickel ore supply originates from Sulawesi, where operations are becoming disrupted more frequently by prolonged rainy seasons. With the Indonesian government tightening restrictions on production quotas, the domestic nickel ore supply is likely to become tighter, increasing reliance on supply from the Philippines. Consequently, expanding HPAL capacities could place further pressure on ore supply.

Third, MHP operations generate substantially more waste than alternative processing routes, with volumes estimated to be 1.5 to 2.0 times higher than those generated during matte production, amplifying environmental and regulatory pressures over the longer term.

What is likely to happen next?

While cobalt production in the DRC has been largely unaffected by the export ban so far, some levels of production cuts are anticipated this year, particularly among small- to medium-sized operations. Any continuation of export restrictions beyond 20 September 2025 is likely to drive further curtailments. Project Blue forecasts that Congolese cobalt intermediate production will decline by 10% y-o-y to approximately 200kt Co in 2025.

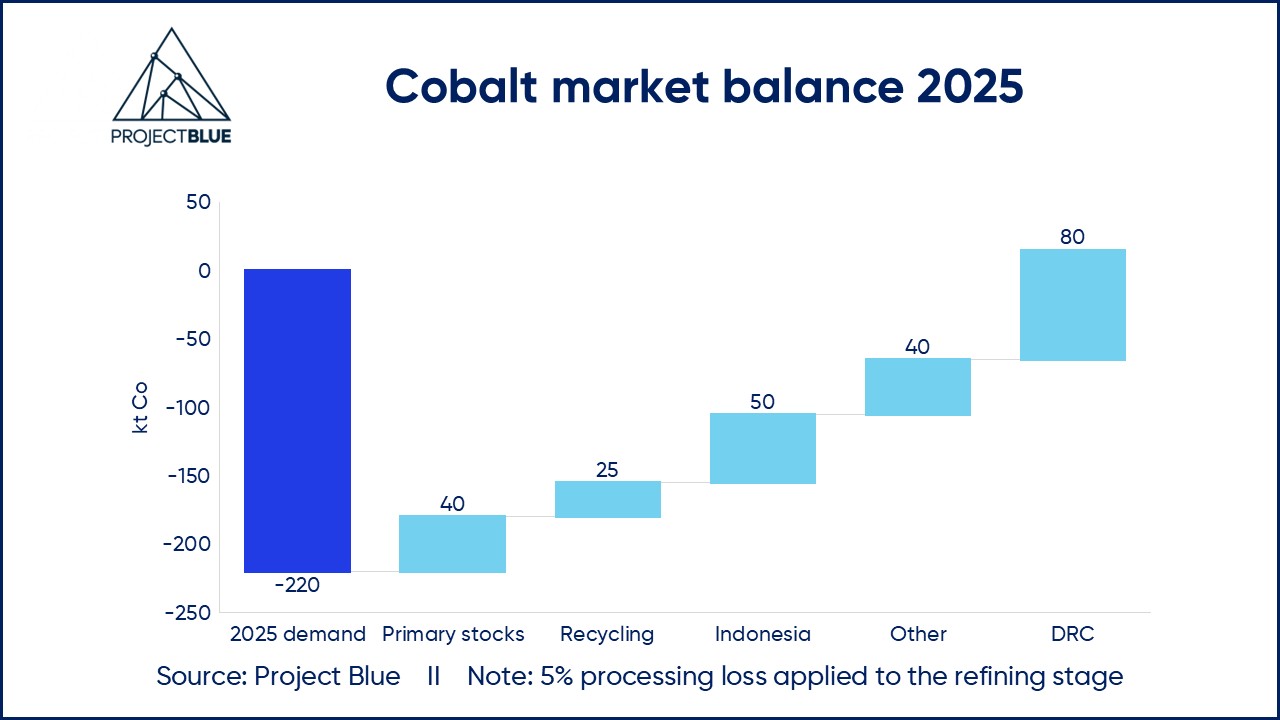

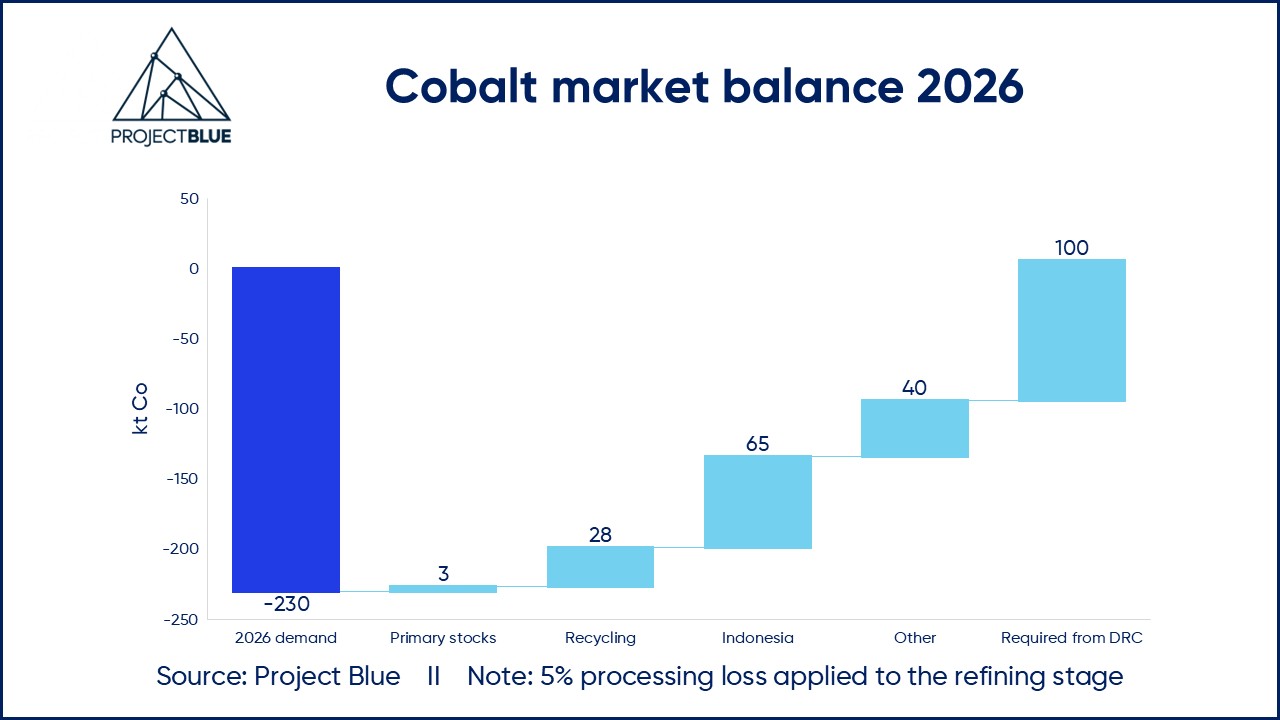

Looking ahead, Project Blue’s latest cobalt supply-demand balance indicates that the global market will require at least 100kt of cobalt from the DRC in 2026—equivalent to roughly half of the country’s 2025 output. This suggests that there may be scope for an extension of the export ban before a transition to a quota-based framework becomes necessary.

How will copper miners be affected?

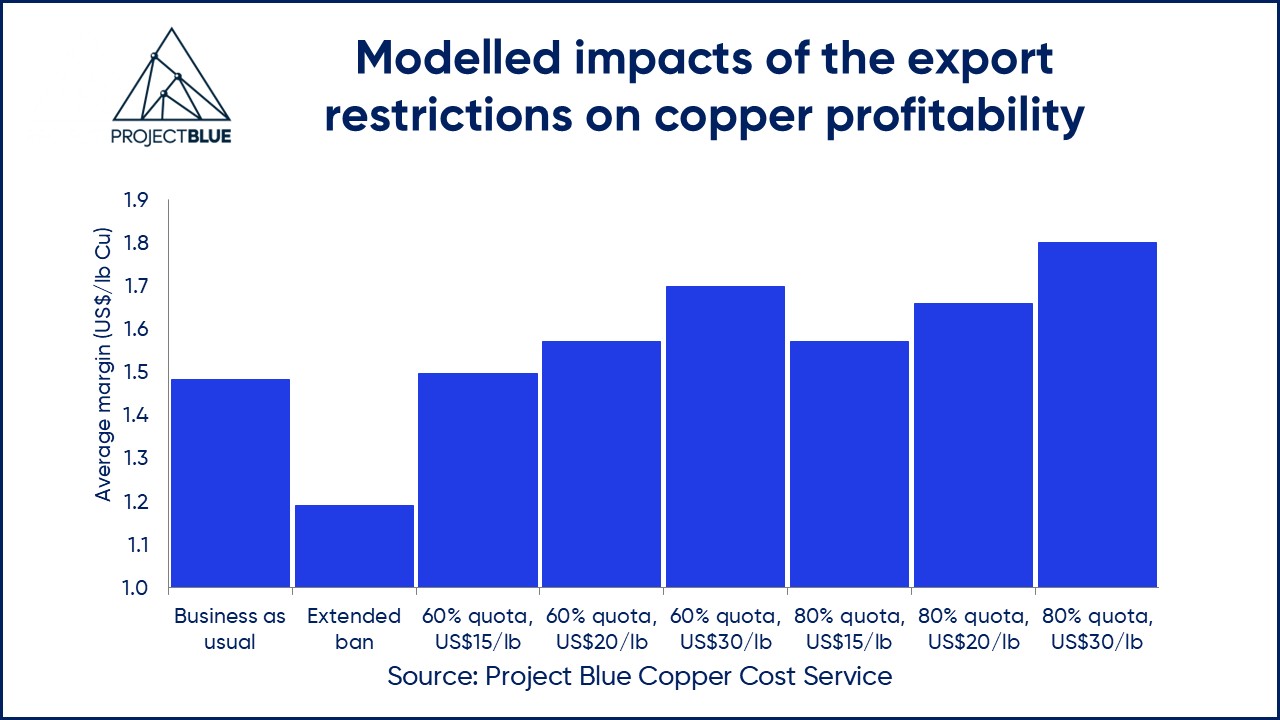

Project Blue has developed eight forward-looking scenarios to assess how potential changes to the DRC’s cobalt export policy might impact copper sector’s profitability in 2026.

The “Business as Usual” scenario

Under this scenario—where no export restrictions are imposed after 20 September 2025 or during 2026—Project Blue projects that approximately 98% of copper–cobalt operations in the DRC will remain profitable. The average production cost for the DRC copper sector is forecast to reach US$2.50/lb Cu on an all-in sustaining cost basis in 2026.

This outlook is based on the following assumptions:

- Copper price: US$4.20/lb (average)

- Cobalt price: US$11.40/lb (average)

- Cobalt hydroxide payables: ~50% of the underlying metal price

The “Extended Ban” scenario

In this scenario, the DRC extends its cobalt export ban for an additional 12 months beyond 20 September 2025. Under such conditions, profit margins for Congolese copper–cobalt producers could decline sharply, falling to below US$1.20/lb Cu, compared with US$1.48/lb Cu under a restriction-free environment.

The loss of cobalt by-product credits would push more than 10% of producers into negative margins. Smaller operations (with output of less than 100ktpa Cu) and those recently transitioning from open-pit to underground mining are expected to be the most vulnerable, absorbing the greatest impact under this scenario.

Other scenarios

The remaining six scenarios examine how the profit margins of copper–cobalt producers in the DRC may shift under two export quota regimes—60% or 80% of production permitted for export in 2026—combined with three cobalt price assumptions as follows: US$15/lb, US$20/lb, and US$30/lb. In all cases, a 70% hydroxide payability is applied.

Notably, the analysis indicates that copper–cobalt producers may, in certain cases, benefit from cobalt export restrictions. Tighter quotas could support higher cobalt prices, which may partially offset the negative impact of lower export volumes (saleable units).

The results further indicate that while cobalt revenues can provide a meaningful boost to profitability, they are unlikely to fundamentally alter the overall economics of the DRC’s copper sector. Lower cobalt prices, when coupled with stricter quotas, would compress margins; however, the majority of producers are still expected to remain profitable even under restrictive export policies.

It is important to recognise that other variables—such as higher cobalt royalties and fluctuations in cobalt hydroxide payables—can materially impact cobalt realisations and, in turn, copper profitability.

Another significant risk arises from potential logistical challenges once the export ban is lifted. Substantial cobalt inventories may accumulate within the DRC in the near term, and the subsequent movement of these materials to local transport depots could result in severe road congestion. This would likely lead to shipping delays and higher freight costs, further increasing realisation costs for copper producers operating in the region.

Gain clarity in a fast-changing cobalt market.

Project Blue’s Cobalt Research Service helps you understand the full value chain—from upstream production to downstream demand—while keeping you informed on trade, pricing, and ESG trends that matter.

Connect with our global team of experts.

This opinion article was prepared by Project Blue’s expert team:

Principal Analyst: Ying Lu

Contributors: Dominic Wells, Linghui Ni