CATL’s supply deal with Ningbo Ronbay: impact on the LFP CAM market

Opinion Pieces

3

Feb

2026

CATL’s supply deal with Ningbo Ronbay: impact on the LFP CAM market

On 13 January 2026, Ningbo Ronbay New Energy Technology (Ronbay), which used to be the biggest ternary cathode active material (CAM) producer in China, announced that it signed a binding agreement to supply Contemporary Amperex Technology (CATL) with 3.05Mt LFP CAM from Q1 2026 to 2031.

The Shanghai Stock Exchange (SSE) promptly issued an inquiry letter questioning Ronbay’s actual fulfillment capabilities and specific terms of the agreement, resulting in suspension of Ronbay’s stock trading between 14 and 16 January. Trade only recommenced on Monday, 19 January, when the company filed a reply to the SSE. After an initial 20% decline from 16 January, Ronbay’s shares recovered 16% on 23 January, but the downtrend continued, with an 18% drop following 26 January.

The contract volume appears too large to be fulfilled

The large volume and technology shift announced by Ronbay aroused widespread market interest. The six-year commitment indicates that Ronbay will supply around 510ktpy LFP CAM on average to CATL, which is much higher than its current capacity of 60ktpy. Less than one month ago, Ronbay extended its business to include LFP CAM after acquiring Guizhou Xinren New Energy Technology (Xinren) in December 2025.

Although Ronbay has disclosed a step-by-step expansion plan (2026: 600ktpy, 2027: 1Mtpy, 2030: 2.6Mtpy), doubts regarding whether capacity can expand so quickly remain. The largest LFP CAM producer in China, Hunan Yuneng New Energy Battery Material (Yuneng), took five years to expand its capacity from 29ktpy to 1Mtpy (2020–2025). Other major LFP CAM suppliers, including Yuneng, Hubei Wanrun New Energy Technology (Wanrun), and Shenzhen Dynanonic (Dynanonic), will be significantly impacted if Ronbay manages to increase its capacity as scheduled and fulfil supply to CATL.

Ronbay kicked off upgrades of existing production lines at its Xinren plant, along with commissioning of its high-energy density LFP CAM capacity from 40ktpy in May 2026 to 300ktpy by July 2026. Two additional plants are planned; however, their locations have not yet been announced. Although these timelines are questionable, some market insiders indicate that with enough capital, it is easy to build such capacities up within short timelines in China.

Based on Ronbay’s reply to the SSE inquiry, the company needs to invest a total of RMB8.7Bn (US$1.25M) into capacity expansion in 2026–2028, with capital from sources such as bank credits and self-owned funds. However, considering Ronbay’s low profitability (2–5% net profit margin) during 2022–2024, and with the expected loss for 2025, such a sizeable investment places a large amount of pressure on the company’s liquidity.

Untested new LFP CAM synthesis technology on a mass production scale

Ronbay also announced that they will be using a new precursor-free technology with only six steps. This highly automated process cuts costs by 40%, reduces energy use by 30%, and produces zero emissions. This technology is likely to be sourced from Shanghai Lianfu New Energy Technology (Lianfu), in which Ronbay has a 30% stake. However, in July 2025, it was still being tested on pilot scale at Lianfu. GCL New Energy has been the only company capable of producing precursor-free LFP CAM on a mass production scale (120ktpy), where, on average, it takes 0.5–2 years for cell manufacturers to qualify cathode materials. From this perspective, LFP CAM delivery from Ronbay to CATL would be minimal within the first year.

Battery giants dictate the upstream CAM market

As the largest battery manufacturer globally, CATL is the top customer for the majority of the leading Chinese CAM suppliers. In 2024, it accounted for nearly one third of Yuneng’s sale revenue, 46% of Dynanonic’s, and 54% of Wanrun’s. However, LFP CAM producers have no leverage on prices as the cell sector is too consolidated, with the top two producers (CATL and BYD) occupying around 60% of the market share.

Except for Yuneng and Fulin Precision (Fulin), most other LFP CAM producers struggled to be profitable during 2023–2025. In late December 2025, leading LFP CAM producers—including Yuneng, Wanrun, Dynanonic, and Lopal Tech (Lopal)—jointly announced that a one-month equipment overhaul would take place, reducing LFP CAM supply by 30–70kt total. This move was deemed to be an attempt to raise the LFP CAM processing/conversion fee, especially after the large increase in raw material costs at the end of 2025.

Leading Chinese LFP CAM producers, including CATL’s suppliers, requested cell manufacturers to increase the processing fee by RMB3,000/t (US$430/t) at the beginning of January. However, market sources indicate that barely any cell manufacturers have accepted this increase, and negotiations are still ongoing. Some LFP CAM producers have settled for an increase of RMB1,000–2,000/t (US$143–287/t). This proposed increase in processing fees is believed to have driven the CATL–Ronbay announcement, underscoring CATL’s market power to bypass established LFP CAM producers that cannot meet its low-cost demands.

According to Project Blue’s calculations, Chengdu Jintang Times New Material Technology and Fulin supply roughly 25–30% of CATL’s LFP CAM demand. Combined with Guangdong Brunp Recycling Technology’s 450kt LFP CAM project and Ronbay’s stated supply, dependence on other suppliers should decrease. However, our views on Ronbay’s capacity expansion rate remain conservative, and we do not believe that it will change the positions that Yuneng, Wanrun, and Lopal currently hold in CATL’s supply chain for 2026–2027.

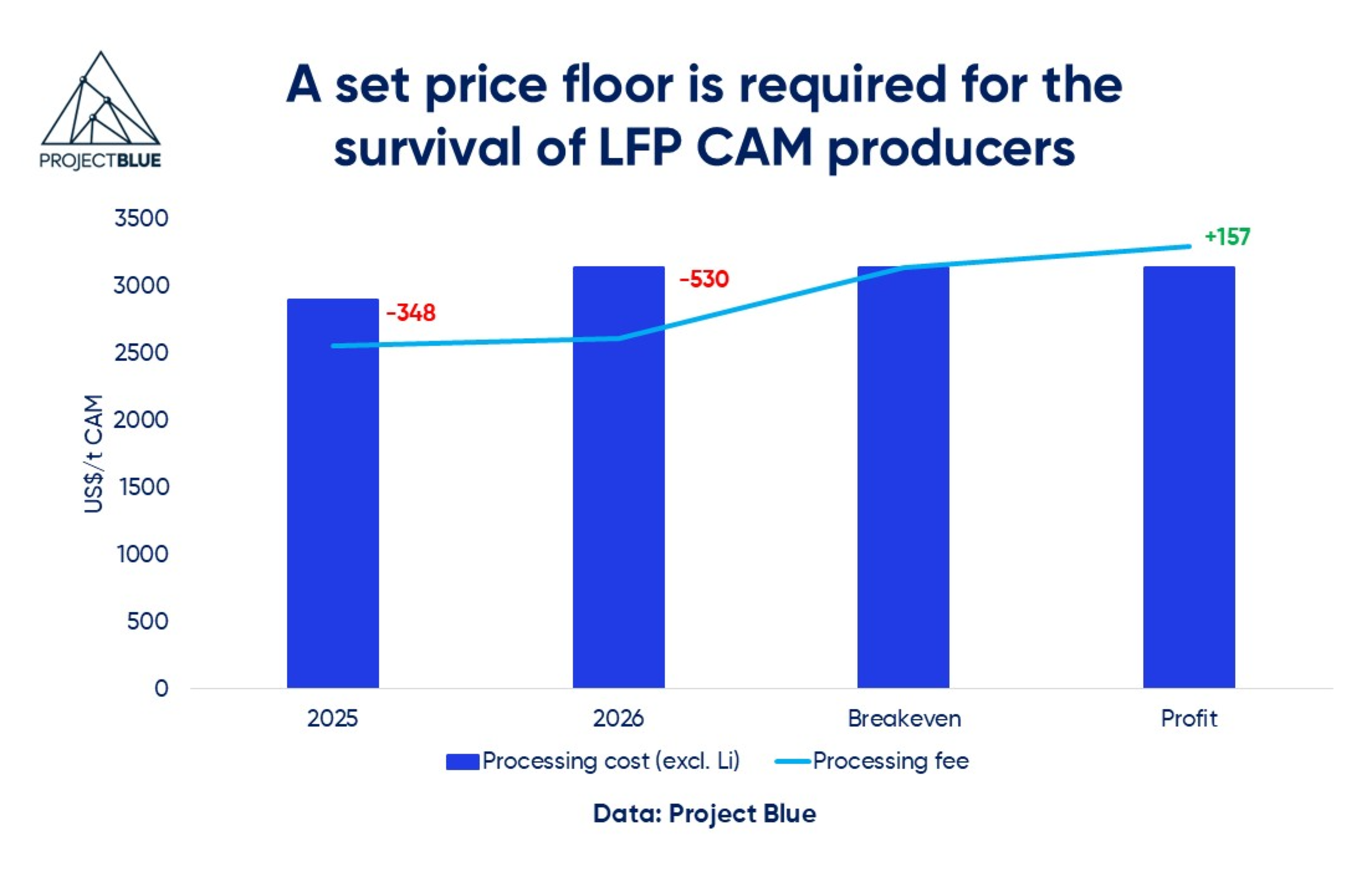

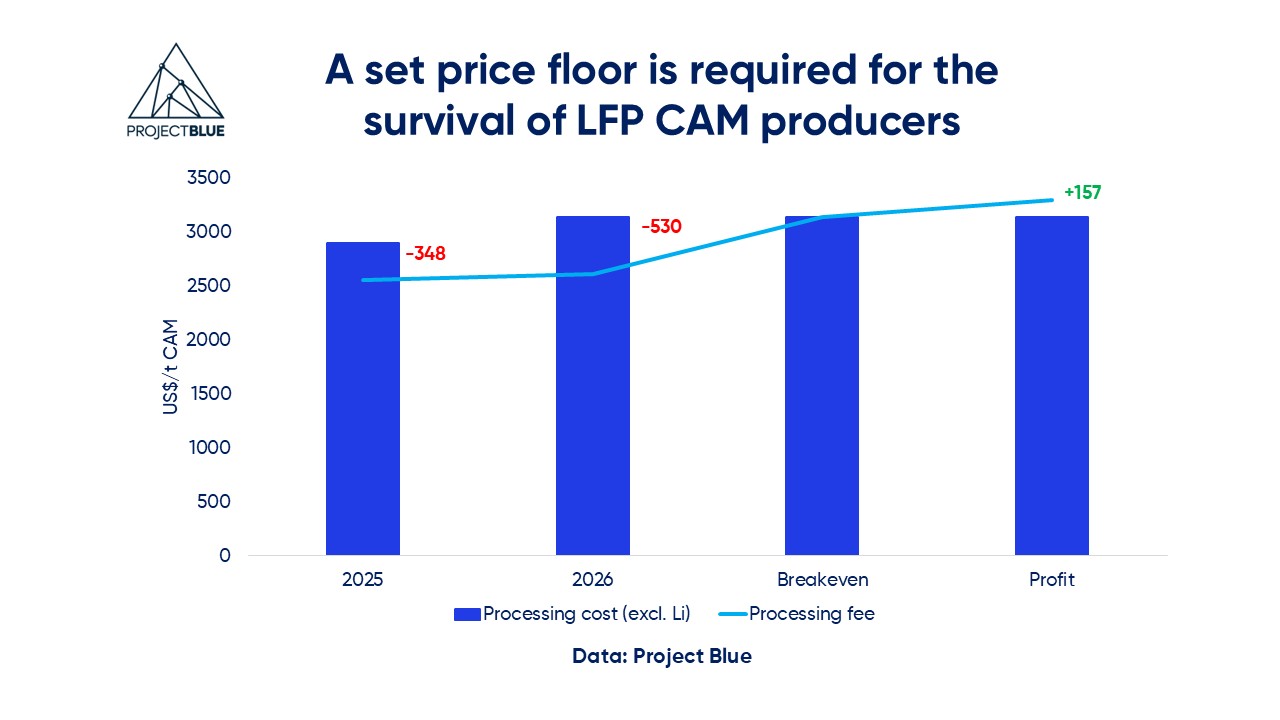

Do or die: a set price floor is required for the survival of LFP CAM producers

Project Blue’s analysis shows that the demanded increase of US$430/t for processing fees, which is widely opposed by cell producers, is not sufficient to sustain viable operations. An estimated increase of RMB4,775/t (US$687/t) is required to place the minimum LFP processing fee at around RMB22,926/t (US$3,298/t), allowing LFP CAM producers to head towards profitability. Since November 2025, raw material costs have surged, with lithium carbonate and iron phosphate prices up by 84% and 13%, respectively. Whilst LFP CAM prices have increased by 52%, this has offset only part of the 40% rise in production costs, leaving CAM producers under more pressure. Meanwhile, LFP cell manufacturers have experienced margin expansion following a 55% increase in cell prices.

The outcome of this tug-of-war between CAM producers and battery cell manufacturers remains uncertain and is unlikely to be resolved in the near term. The structural bargaining advantage held by cell producers constrains the outlook for LFP CAM producers, especially the smaller ones with limited negotiating power. In response, CAM producers are expected to accelerate upgrades and shift towards high-end LFP CAM, allowing them to compete on a performance basis rather than a primarily price-focused basis, which improves leverage. However, a clearer pricing mechanism is also necessary to reflect the real profitability of LFP CAM producers to easily shift rising costs to downstream sectors.

Notes: Industry average cost; Country: China; Chemistry: LFP; Avg Facility size: 100 kt; Processing fee: SMM Gen 3 Processing fee Index