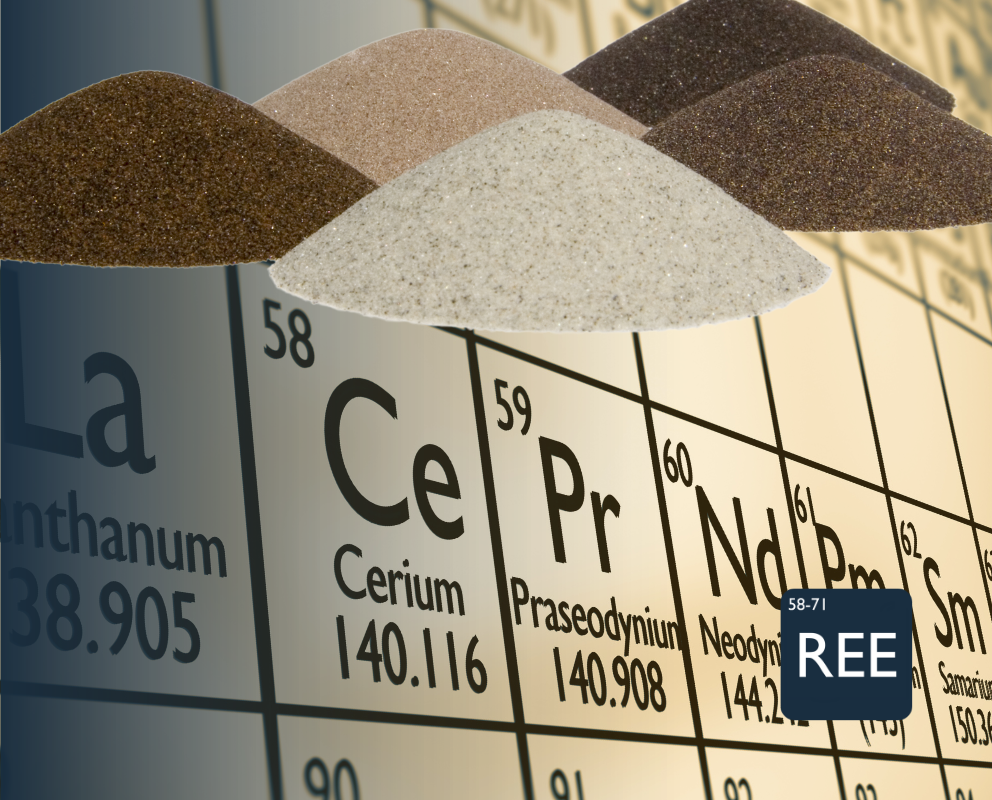

Rare Earth Elements

Research Service

Rare Earth Elements Research Service

China is by far the largest producer, refiner, consumer, and importer of rare earths. Its dominance of the sector has drawn global attention from competing governments and industrial actors, which are set on reducing China’s control of the supply chain. Use the Rare Earths Market Service to understand the dynamics of the rapidly-evolving REE value chain - and track changes in the supply, demand, trade, price and ESG landscape.

Designed To:

- Identify and compare raw material supply options

- Understand material flows through the supply chain

- Keep track of industry price trends and technology/market developments

- Help understand future price directions and market sentiment

- Provide independent demand forecasts and scenarios

Market Overview

Background:a “101” document covering supply chain structure, geology, processing, product forms, and first use applications.

Analysis:covering historical market developments including production, trade, consumption, costs, and price trends.

ESG: containing analysis of the most important environmental, social and governance issues facing the supply chain.

Market outlook

Short-term outlook:setting out key market developments over the previous month and our three-month outlook for trends and prices.

Medium-term outlook:detailing current market trends and setting out our ten-year forecasts for supply, demand, and prices with scenarios.

Long-term outlook:outlining our view of the market over the energy transition horizon to 2050 with scenarios.

Market analysis tools

Proxima profiles:explore and understand all key assets, companies, and countries engaged in the supply chain.

Interactive data:all the key underlying data required to embed into your workflows.

Long-term outlook:outlining our view of the market over the energy transition horizon to 2050 with scenarios.

Market support

Access:our expert team will be available to discuss key market trends and forecasts

Notifications:of key market events will be sent via our online portal